97 results found | searching for "Oncology"

-

Pharmaceutical Giants Rush to Develop PD-(L)1 Bispecific Antibodies: A New Battlefield in Immunotherapy In recent years, immune checkpoint inhibitors (ICIs) have emerged as a significant breakthrough in cancer therapy, reshaping traditional treatment paradigms. PD-1/PD-L1 pathway inhibitors have been widely used across various cancer treatments, demonstrating impressive efficacy. As PD-(L)1 inhibitor therapies continue to mature, pharmaceutical giants have turned their attention to PD-(L)1 bispecific antibodies (BsAbs), a new class of antibody drugs that has become a hot field for development in the industry. The key advantage of PD-(L)1 bispecific antibodies is their ability to target both PD-1 and PD-L1 simultaneously, not only enhancing anti-tumor activity through stronger immune activation effects but also overcoming the limitations of single-target antibodies. As a result, pharmaceutical companies have invested heavily in developing PD-(L)1 bispecific antibodies, striving to achieve breakthroughs in this area. PD-(L)1 bispecific antibodies are one of the brightest stars in antibody drug development. These bispecific antibodies can recognize two different antigens or targets at the same time, resulting in a synergistic effect. In their design, bispecific antibodies not only block the binding between PD-1 and PD-L1 but also recruit immune cells, enhancing the immune system's ability to attack tumors. This "two-pronged" strategy has made PD-(L)1 bispecific antibodies a focal point in cancer immunotherapy. Currently, numerous pharmaceutical and biotechnology companies are actively advancing the clinical research of PD-(L)1 bispecific antibodies, especially in cancer immunotherapy, where they show significant promise. Some PD-(L)1 bispecific antibodies can not only target immune evasion mechanisms within the tumor microenvironment but also significantly improve patient survival, positioning them as the "new favorite" in cancer immunotherapy. The PD-1/PD-L1 Pathway and Mechanism of Immune Escape PD-1 (Programmed Cell Death Protein 1) is a crucial checkpoint in the immune system. By binding to its ligand PD-L1, PD-1 inhibits T-cell activation, regulating immune responses and preventing excessive immune reactions that could harm the body's tissues. However, tumor cells often exploit this mechanism to evade immune surveillance, promoting their growth and metastasis. The role of the PD-1/PD-L1 pathway in immune evasion makes it a key target for immunotherapy. The application of PD-1 and PD-L1 monoclonal antibodies helps to relieve immune suppression, restore T-cell function, and boost the immune system's ability to recognize and eliminate tumor cells. As a result, immune checkpoint inhibitors are widely used in the treatment of various cancers, including non-small cell lung cancer, melanoma, and renal cell carcinoma. Despite the promising clinical efficacy of PD-1/PD-L1 inhibitors, challenges remain. Some patients develop resistance to these therapies, and side effects, such as immune-related adverse events, can complicate clinical application. This has driven researchers and pharmaceutical companies to explore new treatment options, with bispecific antibodies emerging as a promising solution. In the development of immunotherapy drugs, the use of cell models plays a critical role. Human PD-1 recombinant cell lines are among the most essential tools for studying the PD-1 pathway, widely used for drug screening, mechanistic research, and preclinical evaluation. By stably expressing the PD-1 protein in cells, researchers can simulate interactions between immune cells and tumor cells, explore the mechanisms of the PD-1/PD-L1 pathway, and evaluate the efficacy of PD-1/PD-L1 targeted therapies. For example, using these recombinant cell lines, researchers can simulate immune escape processes in the tumor microenvironment, investigate the mechanisms of action of PD-1 inhibitors, and screen new antibody drugs. This tool is also crucial in evaluating the preclinical potential of drugs, contributing to the advancement of anti-tumor immunotherapies. As the field of immunotherapy continues to evolve, the clinical application of PD-1/PD-L1 inhibitors has made significant strides. However, several challenges remain, particularly related to individual variation, resistance, and side effects. Researchers are actively exploring combination therapies to enhance treatment outcomes, such as combining PD-1 inhibitors with chemotherapy, targeted therapies, or vaccines. This may help overcome resistance and improve the overall efficacy of treatment. Furthermore, as new immunotherapy strategies emerge, the application of PD-1 and related treatments may extend beyond cancer. Immune checkpoint inhibitors are showing promise in autoimmune diseases, infectious diseases, and other areas, making them a key focus in future medical research. From the early days of single-target therapies to the current focus on bispecific antibodies, immunotherapy continues to innovate, transforming cancer treatment approaches. With the emergence of PD-1 recombinant cell lines and new immunotherapy solutions, we can look forward to a new era in cancer therapy, where more patients will benefit and the full potential of immunotherapy will be unlocked. https://www.creative-biolabs.com/immuno-oncology/human-pd-1-recombinant-cell-line-jurkat-2696.htm

-

Effective Colon Cancer Treatment in India – GoMedii Seeking effective colon cancer treatment? GoMedii connects you with the best medical experts and advanced facilities in India. With personalized treatment plans and affordable healthcare options, GoMedii ensures you receive the highest quality of care for colon cancer. Get access to cutting-edge therapies and holistic support throughout your treatment journey. Let us help you take the first step towards healing. Colon cancer, cancer treatment in India, GoMedii, affordable cancer care, oncology treatment, cancer therapies, medical tourism India, colon cancer surgery, chemotherapy treatment, personalized cancer care, best cancer hospitals. https://gomedii.com/treatments/colon-cancer-treatment?lang=en

-

Folinic Acid Market Size and Share in 2024: The Folinic acid market is poised for continued growth in 2024, driven by its essential role in oncology, the treatment of folate deficiencies, and its increasing use in various medical therapies. Folinic acid, also known as leucovorin, has proven to be an effective agent in reducing the toxic effects of chemotherapy drugs, particularly methotrexate, and plays a key role in folate supplementation. Fore more info:- https://blog.aajjo.com/post/folinic-acid-market-2024-growth-demand-and-future-opportunities?_gl=1*1ppdp5r*_gcl_au*MzIyNDIxNzkwLjE3MzA3ODk3OTYuODM3MzQ2ODc2LjE3MzA3ODk3OTguMTczMDc4OTc5Nw..*_ga*MjAzNjUwMDUxLjE3MjI1MDYxMTI.*_ga_J3VC4M77BN*MTczMTQ4MjgxOC4yNzAuMS4xNzMxNDgzMDI2LjQyLjAuMA..

-

Global Interventional Oncology Market Worth $2.9 Billion by 2026: Key Insights and Analysis https://www.marketsandmarkets.com/Market-Reports/interventional-oncology-market-203687164.html The global interventional oncology market size is expected to grow from USD 1.9 billion in 2020 to USD 2.9 billion in 2026, at a CAGR of 6.8% during the forecast period. Technological advancements in the market are propelling the growth of the interventional oncology market. Additionally, rising incidence of infectious diseases, and increased funding and public-private investments are some of the key factors driving the growth of the interventional oncology market. Download a PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=203687164 Based on product, the interventional oncology market is segmented into ablation devices, embolization devices, and support devices. The embolization devices segment accounted for the largest share of 63.8% of the interventional oncology market in 2020. The large share of this segment can be attributed to the rising prevalence of cancer, product enhancements, and the increasing adoption of Yttrium-90 radioembolic agents in emerging countries. Ongoing technological advancements in the field of oncology, rising prevalence of cancer, high healthcare expenditure, are the major factors supporting market growth. Based on procedure, the interventional oncology market is segmented into thermal tumor ablation, non-thermal tumor ablation, transcatheter arterial chemoembolization (TACE), transcatheter arterial radioembolization (TARE) or selective internal radiation therapy (SIRT), and transcatheter arterial embolization (TAE) or bland embolization. In 2020, the TARE/SIRT procedures segment accounted for the largest market share, mainly due to the rising prevalence of cancer, increasing demand for minimally invasive procedures, growing adoption of embolization procedures, and the clinical efficacy of Yttrium-90 radioembolic agents (which are used in these procedures). Based on cancer type, the interventional oncology market is segmented into liver cancer, kidney cancer, lung cancer, bone cancer, and other cancers (includes pediatric cancer, prostate cancer, and breast cancer). The liver cancer segment accounted for the largest share of 63.8% of the interventional oncology market in 2020. The large share of this segment can be attributed to factors such as rising cases of liver cancer across the globe and growing initiatives/research activities for developing advanced liver cancer therapies using interventional oncology. Based on end users, the interventional oncology market is segmented into hospitals, ambulatory surgery centers, and research & academic institutes. Hospitals accounted for the largest share of the market in 2020. The large share of this end-user segment can be attributed to the presence of advanced ICUs & emergency wards in hospitals and the increasing number of surgical procedures performed in hospitals. The interventional oncology market is segmented into five major regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. In 2020, North America was the largest regional market for interventional oncology, with a share of 43.2%. Factors such as continuous development and commercialization of novel interventional oncology products and favorable reimbursements & insurance coverage drive the market for interventional oncology in North America. The Asia Pacific is estimated to be the fastest-growing regional market for interventional oncology. This is due to the rising patient population increasing GDP and healthcare expenditure and growing public awareness about various surgical treatments. Major Players: Medtronic (Ireland), Boston Scientific (US), BD (US), Terumo (Japan), Merit Medical (US), AngioDynamics (US), J&J (US), Teleflex (US), Cook Medical (US), HealthTronics (US), MedWaves (US), Sanarus (US), IMBiotechnologies (Canada), Trod Medical (US), IceCure Medical (Israel), Mermaid Medicals (Denmark), Interface Biomaterials BV (Netherlands), Guerbet (France), ABK Biomedical (Canada), Shape Memory Medical (US), Endo Shape (US), Monteris Medical (US), Instylla (US), Trisalus Lifesciences (US), Profound Medical Corp (Canada), Sirtex (US), Accuray (US), Baylis Medical (Canada), and ALPINION MEDICAL SYSTEMS (South Korea). Recent Developments In 2021, Boston Scientific (US) launched Launched the TheraSphere Y-90 Glass Microspheres In 2018, Merit Medical Systems (US) launched the Preclude IDeal Hydrophilic Sheath Introducer in EMEA markets In 2018, IMBiotechnologies (US) launched ‘Ekobi 500 Embolization Microspheres’ with an enhanced feature of detectability using ultrasound technology. In 2018, Medical City and distributor Gulf Medical Company to install the first IMRIS Surgical Theatre in Saudi Arabia. In 2018, Medtronic (Ireland) launched its OptiSphere embolization spheres designed for hypervascular tumor embolization in the US

-

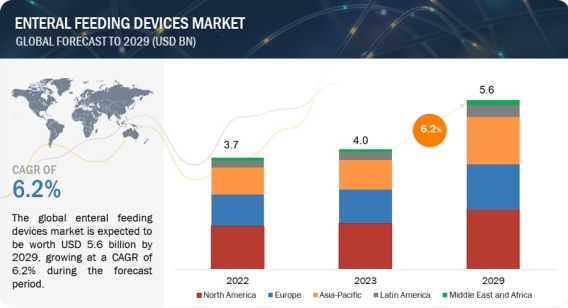

Global Enteral Feeding Devices Market Worth $5.6 Billion by 2029: Key Insights and Analysis https://www.marketsandmarkets.com/Market-Reports/enteral-feeding-device-market-183623035.html The global enteral feeding devices market is projected to reach 5.6 billion in 2029 from USD 4.0 billion in 2023, at a CAGR of 6.2% between 2023 and 2029. The rising technological advancemnets and increasing geriatric population is driving the growth of the market. The As the global population ages, the number of individuals requiring enteral feeding is expected to rise. Download a PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=183623035 Elderly patients often experience age-related decline in appetite or swallowing difficulties, making enteral feeding a vital support system. Based on type, the enteral feeding devices market is segmented into enteral feeding tubes, enteral feeding pumps, administration sets, enteral syringes and consumables. The enteral feeding tubes accounts for the largest share in the enteral feeding devices market, Enteral feeding tubes are a crucial component of enteral feeding devices. They act as a conduit to deliver liquid nutrition directly into a patient's stomach or small intestine, bypassing the mouth and esophagus. Enteral feeding tubes are essential components of enteral feeding devices, providing a safe and reliable way to deliver essential nutrients to patients who cannot consume food orally which is expected to drive the segment growth. Based on application, the enteral feeding devices market is segmented into oncology, gastrointestinal diseases, nuerological diseases, diabetes, hypermetabolism and other applications. The oncology accounts for the largest share in the enteral feeding devices market, cancer and its treatment (surgery, radiation, chemotherapy) can significantly impact a patient's appetite and ability to absorb nutrients. Enteral feeding ensures they receive the necessary calories, proteins, vitamins, and minerals to support their immune system, fight infection, and promote healing which is expected to drive the market growth. In 2023, North America accounted for the largest share of the enteral feeding devices market, followed by Europe and Asia Pacific. The United States and Canada have well-equipped hospitals and a strong focus on advanced medical care, which supports the adoption of enteral feeding devices, also compared to established markets like North America and Europe, the Asia Pacific region often offers lower labor costs, making it an attractive option for companies seeking to optimize manufacturing expenses. Additionally, several countries in the region, like China and India, have developed a robust infrastructure for manufacturing pharmaceuticals and medical devices which is expected to lead to Asia Pacific growing at the fastest rate during the forecast period. The major players in the enteral feeding devices market include include The prominent players in the medical device contract manufacturing market include Fresenius SE & Co. KGAA (Germany), Cardinal Health, Inc. (US), Nestlé S.A. (Switzerland), Avanos Medical, Inc. (US), Danone S.A. (France), Becton, Dickinson and Company (US), B. Braun Melsungen AG (Germany), CONMED Corporation (US), Cook Medical (US), Moog Inc. (US), Boston Scientific Corporation (US), Baxter International Inc. (US), Vygon (France), and Other players in the enteral feeding devices market are Applied Medical Technology (US), Amsino International Inc. (US), Omex Medical Technology (India), Danumed Medizintechnik (Germany), Medline Industries, Inc. (US), Fuji Systems (Japan), Kentec Medical (US), Dynarex Corporation (US), Vesco Medical LLC (US), Medela AG (Switzerland), Alcor Scientific (US), and Romsons (India) Recent Developments of Enteral Feeding Devices Industry: In September 2022, Cardinal Health, Inc. (US) announced the partnership with Kinaxis (Canada) to enhance the Kinaxis RapidResponse Platform used for supply chain agility and medical product visibility. In November 2022, Boston Scientific signed an agreement for the acquisition of Apollo Endosurgery, Inc.,. This agreement includes devices, which are used during endoluminal surgery (ELS) procedures, to close gastrointestinal defects, manage gastrointestinal complications, and aid in weight loss for patients suffering from obesity. In March 2021, Applied Medical Technology, Inc. (US) launched its gastric-jejunal enteral feeding tube family (G-JETs) to include the low-profile micro-G-JET to link up the enteral nutrition needs of pediatric patients. In March 2022, Vygon Group (France) announced the acquisition of distributor Macatt Medica (Peru). The acquisition is expected to grow the presence of Vygon Group (France), in the South American region, specifically for its broad range of enteral feeding products.

-

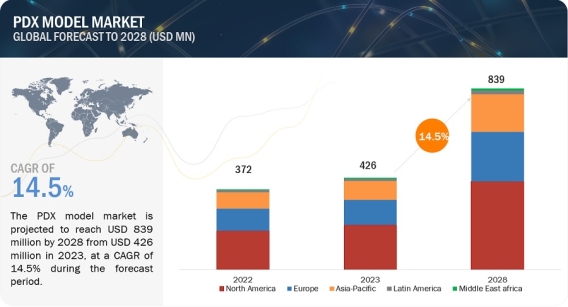

PDX Model Market Worth $839 Million: Opportunities and Challenges https://www.marketsandmarkets.com/Market-Reports/patient-derived-xenograft-model-market-121598251.html The PDX model market is projected to reach USD 839 million by 2028 from USD 426 million in 2023, at a CAGR of 14.5% during the forecast period. The key factors driving the growth of the global patient-derived xenograft/ PDX model market are the enhanced preclinical predictability, advancement of personalized medicine, and rise in the prevalence of cancer. However, ethical concerns surrounding the use of animal models along with high associated costs are expected to restrain market growth to a certain extent. Download a PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=121598251 The patient-derived xenograft/ PDX model market is categorized into five major categories: type, implantation method, tumor type, application, and end user. Based on type, the patient-derived xenograft/ PDX model market is segmented into mouse model and rat model. In 2023, the mouse model segment dominated the patient-derived xenograft/ PDX model market. Growth in this market segment can be attributed to biological similarities of the mice model with human tumors, and the availability of immunodeficient strains is expected to form the largest share segment in the patient-derived xenograft/ PDX model market. Based on implantation method, the market is categorized into subcutaneous implantation, orthotopic implantation, and other implantation methods. In 2023, the subcutaneous segment accounted for the largest share of the patient-derived xenografts/ PDX models market. The major drivers are propelling the accessibility and ease of Implantation of the subcutaneous method and the cost and time efficiency of the method. Based on tumor type, the patient-derived xenograft/ PDX model market is categorized into gastrointestinal tumor models, gynecological tumor models, respiratory tumor models, urological tumor models, hematological tumor models, and other tumor models. The hematological tumor models segment accounted for the fastest-growing segment of the tumor type segment of the patient-derived xenograft/ PDX model market. Market growth can largely be attributed to factors such a continuous rise in the incidence of hematological malignancies which is supporting research of treatments against hematological malignancies, and a growing focus on targeted therapies against cancer among others. Based on application, the patient-derived xenograft/ PDX model market is segmented into preclinical drug development, biomarker analysis, translational research, and biobanking. Among these, the preclinical drug development application segment accounted for the largest share of the patient-derived xenografts/ PDX models application market. The major driver fueling the growth of the patient-derived xenografts/ PDX models market is a constant increase in the number of ongoing clinical trials and the use of PDX models in the development of personalized therapeutic regimens for oncology treatments. Based on the end user, the segment is categorized into pharmaceutical & biotechnology companies, contract research organizations (CROs), and academic & research institutions. In 2023, the pharmaceutical and biotechnology companies segment dominated the end-user segment with the highest revenue share. Collaborative projects amongst the pharmaceutical and biotechnology companies, rising numbers of drugs in the R&D pipeline, and increasing investment in R&D are propelling the growth of the pharmaceutical and biotechnology companies market. Based on region, North America accounted for the largest share of the patient-derived xenografts/ PDX models market. The large share of the North American region can be attributed to extensive research focusing on novel oncology therapies, a rise in cancer prevalence, and increased adoption of personalized medicine. Moreover, the APAC region offers lucrative growth potential for the PDX models market. This can be attributed to the supportive regulatory framework, ongoing expansion and modernization of healthcare infrastructure across emerging Asian countries, and public-private initiatives to encourage awareness about personalized medicine. Major players operating in the patient-derived xenograft/ PDX model market include JSR Corporation (Japan), Wuxi Apptec (China), The Jackson Laboratory (US), Charles River Laboratories International, Inc. (US), Taconic Biosciences, Inc. (US), Oncodesign Precision Medicine (France), Inotiv, Inc. (US), Pharmatest Services (Finland), Hera BioLabs (US), EPO Berlin-Buch GmbH (Germany), Xentech (France), Urosphere (France), Altogen Labs (US), Abnova Corporation (US), Genesis Biotechnology Group (US), Biocytogen Pharmaceuticals Co., Ltd. (China), Creative Animodel (US), BioDuro-Sundia (US), Aragen Life Sciences (India), Shanghai LIDE Biotech Co., Ltd. (China), Certis Oncology Solutions (US), InnoSer (Netherlands), IVRS AB (Sweden), Beijing IDMO Co. Ltd. (China), and Shanghai Chempartner Co. Ltd. (China). Recent Developments in PDX Model Industry In December 2022, Crown Bioscience, Inc., a subsidiary of JSR Life Sciences, entered into a worldwide licensing agreement with ERS Genomics Limited. This agreement granted Crown Bioscience complete global access to ERS's foundational CRISPR/Cas9 patent portfolio, enabling the company to utilize CRISPR/Cas9 for genetic editing on a global scale. Under the provisions of this agreement, Crown Bioscience broadened its capabilities in genetic manipulation. The company is exploring the potential of gene editing within three-dimensional models of patient-derived tumor organoids. In July 2022, GemPharmatech entered into a strategic licensing arrangement with Charles River Laboratories, Inc. This partnership entails the exclusive distribution rights for GemPharmatech's advanced NOD CRISPR Prkdc Il2r gamma (NCG) mouse lines within the North American region. In November 2021, Inotiv announced the completion of the acquisition of Envigo RMS Holding Corp., a leading global provider of research models and services.

-

Market Surge: Multiplex Assays Expected to Hit $5.3 Billion https://www.marketsandmarkets.com/Market-Reports/multiplex-assays-market-61593314.html The multiplex assays market is valued at an estimated USD 3.5 billion in 2022 and is projected to reach USD 5.3 billion by 2027, at a CAGR of 8.8% during the forecast period. The increasing applications of companion diagnostics in drug development and the significance of multiplex assays in companion diagnostics are expected to drive the multiplex assays market. Download a PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=61593314 Based on product & service, the multiplex assays market is segmented into three broad categories, namely, consumables, instruments, and software & services. In 2022, the consumables segment accounted for the largest share of the market. The availability of a wide range of reagents and kits and increasing use of assays in different oncology therapeutic treatments are some of the major factors driving the growth of the consumables market. On the basis of type, the multiplex assays market is segmented into protein, nucleic acid, and cell-based multiplex assays. The nucleic acid multiplex assays segment is further divided into planar, bead-based, and other nucleic acid multiplex assays. The protein multiplex assays segment is further categorized into planar, bead-based, and other protein multiplex assays. The protein multiplex assays segment accounted for the largest share of the global multiplex assays market in 2022. Protein multiplex assays are preferred over traditional protein analysis tools mainly due to their distinct advantages, such as the simultaneous profiling of multiple analytes using smaller sample amounts. Such distinct features make protein multiplex assays more suitable for research applications where samples are scarce and valuable resources. This is expected to support market growth of this segment. Based on technology, the multiplex assays market is divided into flow cytometry, fluorescence detection, luminescence, multiplex real-time PCR, and other technologies. In 2022, the flow cytometry segment accounted for the largest share of the global multiplex assays market. Its wide applications in protein expression, RNA, and cell health status makes it the largest market segment. Based on applications, the multiplex assays market is segmented into research & development (drug discovery & development and biomarker discovery & validation) and clinical diagnostics (infectious diseases, cancer, cardiovascular diseases, autoimmune diseases, nervous system disorders, metabolism & endocrinology disorders, and other diseases). The research & development application segment is expected to account for the largest share of the multiplex assays market in 2022. Multiplex assays are easy to use and are associated with reduced turnaround times, owing to which they are preferred for research & development applications as compared to conventional single plex assays. The global multiplex assays market has been segmented into five major regions— North America, Europe, the Asia Pacific, and the Rest of the World (RoW). In 2022, North America accounted for the largest share of the global multiplex assays market. The large share of North America in the global market is attributed to factors such as the rising amount of government funding for R&D in multiplex assays; an increasing number of seminars and workshops about emerging technologies in the domain of multiplex assays; the growing adoption of companion diagnostics for personalized treatment; and the rising need for effective analytical platforms to reduce operational costs. Major Companies: Illumina, Inc. (US), Thermo Fisher Scientific, Inc. (US), Bio-Rad Laboratories, Inc. (US), Becton, Dickinson and Company (US), DiaSorin S.p.A. (Italy), QIAGEN N.V. (Netherlands), Abcam plc (UK), Merck KGaA (Germany), Agilent Technologies, Inc. (US), Quanterix (US), Bio-Techne (US), MESO SCALE DIAGNOSTICS, LLC (US), Randox Laboratories Ltd. (UK), Olink (Sweden), Seegene Inc. (South Korea), Siemens Healthcare AG (Germany), PerkinElmer Inc. (US), Shimadzu Corporation (Japan), Promega Corporation (US), Enzo Biochem Inc. (US), Cayman Chemical (US), Boster Biological Technology (US), Antigenix America, Inc. (US), Quansys Biosciences Inc. (US), and RayBiotech Life, Inc. (US). Recent Developments In September 2021, Bio-Rad Laboratories launched its Bio-Plex Pro Human IgA and IgM SARS-CoV-2 panels to detect IgA and IgM antibodies against four SARS-CoV-2 antigens. The panels are for research use only (RUO). In September, DiaSorin S.p.A. received the CE mark approval for its Simplexa COVID-19 & Flu A/B Direct kit, a multiplex test for the in vitro qualitative detection and differentiation of nucleic acid from severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), influenza A virus, and influenza B virus from the same patient sample in one reaction well. The assay is designed for use on the LIAISON MDX and is run directly from nasopharyngeal swabs (NPS) without the need for offboard extraction. In August 2021, Becton, Dickinson and Company launched its new and fully automated high-throughput diagnostic system, BD COR System. The system uses robotics and sample management software algorithms to set a new standard in automation for infectious disease molecular testing in core laboratories and other centralized laboratories in the US. In July 2021, DiaSorin S.p.A. acquired the leading company of multiplex assays, Luminex Corporation, for a price of USD 37.00 per share, that corresponds to a total equity value of approximately USD 1.8 billion. In February 2021, Thermo Fisher Scientific acquired Mesa Biotech, a privately-held point-of-care molecular diagnostic company. This acquisition strengthened Thermo Fisher's operational excellence, access to raw materials, and existing distribution & sales channels with Mesa's innovative platform with a diverse array of diagnostic products, such as Accula System by Mesa Biotech that is dedicated to COVID-19 testing.

-

2027 Outlook: Diagnostic Imaging Services Market to Achieve $702.6 Billion https://www.marketsandmarkets.com/Market-Reports/diagnostic-imaging-service-market-17157849.html The diagnostic imaging services market is projected to reach USD 702.6 billion by 2027 from USD 549.0 billion in 2022, at a CAGR of 5.1% during the forecast period. Factors such as increasing prevalance of chronic diseases, rapidly growing geriatric population, technological adavancements in imaging modalities, and rising demand for early diagnosis of diseases are anticipated to propel the growth of market during the forecast period. Howerevr, rising cost of diagnostic imaging equiments, shortage of skilled workforce and unfavorable reimbusment structure of out patient imaging facilities in lower income countries are are anticipated to hamper the overall growth of the market. Download a PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=17157849 Diagnostic Imaging Services Market Size, Growth by Procedure (MRI, Ultrasound, CT, X-RAY, Nuclear Imaging, Mammography), Application (OB/Gyn, Pelvic/Abdomen, Cardiology, Oncology, Neurology), Technology, User (Hospitals, Diagnostic Centers) - Global Forecast to 2027 The diagnostic imaging services market is segmented on application into general radiography, dentistry, and other X-ray applications. The general radiography segment will dominate the market during the forecast period. The large share of this application segment can be attributed to the rising prevalence of lung diseases globally and the increasing use of 3D X-ray imaging technogy in applications for chest, orthopedic & rheumatological, and cardiovascular imaging Based on end users, the diagnostic imaging services market is segmented into hospitals, diagnostic imaging centers, ambulatory care centers, and research & academia. In 2021, hospitals were the largest diagnostic imaging services market end users. The large share of the hospitals segment can be attributed to growing adoption of 3D imging technology, increasing adoption of minimally invasive procedures and ongoing collaboration with market players to adopt diagnostic imaging solutions. In April 2022, Siemens Healthineers (Germany) collaborated with Oulu University Hospital (Finland) to expand radiology solutions through supplying, installing, and maintaining medical imaging technology and software training in Finland. Based on region, the diagnostic imaging services market is segmented into North America, Europe, the Asia Pacific, Latin America, and Middle East and Africa. North America accounted for the largest share of the diagnostic imaging services market in 2021. The growth of the North American market is primarily driven by the strong foothold of key players in the region offering wide range of diagnostic imaging services. increased collbartion among imaging service providers and diagnostic centers , rapid adoption of highly adavanced imaging technology, and rising volume of imaging scans performed anully in the region. The major player in the market includes RadNet, Inc. (US), Sonic Healthcare (Australia), Akumin Inc. (US), Healius Limited (Australia), RAYUS Radiology (US), Dignity Health (US), Novant Health (US), Alliance Medical (UK), InHealth Group (UK), Apex Radiology (Australia), Concord Medical Services Holdings Limited (China), Unilabs (Switzerland), Affidea (Netherlands), I-MED Radiology Network (Australia), Capitol Imaging Services (US), SimonMed (US), among others Recent Developments: In 2022, Radnet, Inc. acquired Quantib and Aidence with an aim to expand its cancer screening portfolio for breast, prostate, and lung cancers through the integration of AI technology. In 2021 , Sonic Healthcare announced the acquisition of Canberra Imaging Group (Australia) to helped strengthen Sonic Healthcare’s geographic footprint in the Australian diagnostic imaging services market. In 2021, Akumin Inc. acquired Alliance Healthcare to enhance its diagnostic imaging service portfolio.

-

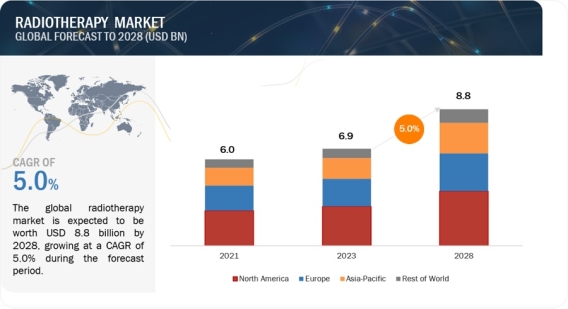

Market Surge: Radiotherapy Expected to Hit $8.8 Billion by 2028 https://www.marketsandmarkets.com/Market-Reports/radiotherapy-monitoring-devices-market-567.html The global radiotherapy market is valued at USD 6.9 billion in 2023 and is expected to reach USD 8.8 billion by 2028, at a CAGR of 5.0% during the forecast period. The expanding prevalence of cancer worldwide and the rising aging population has increased the demand for advanced and non-invasive cancer treatment. According to National Institute of Health (NIH), approximately 1,958,310 new cancer cases are expected to be registered in US by end of 2023. Download a PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=567 Radiotherapy Market by Type (Product, Service), Technology(MRI LINAC, Stereotactic, Particle Therapy, Cobalt-60 Teletherapy), Procedure (IMRT, IGRT, 3D-CRT, LDR, HDR), Application (Prostate, Breast, Lung), End User (Hospital) - Global Forecast to 2028 Rising technological advancements in radiotherapy systems and software are playing a significant role in offering precise and personalized cancer treatment. Additionally, investments in oncology research activities by public & private organizations and initiatives by government to enhance the accessibility of radiotherapy devices are likely to contribute towards the significant growth of market during the forecast period. However, high cost associated with device procurement , limited financial budget, lack of health insurance coverage and inadequate healthcare infrastructure in low-income countries are likely to hinder the growth of radiotherapy market during the forecast period. On the basis of type, the radiotherapy market is segmented into products and software & services. The products segment accounted for the largest share of radiotherapy market in 2023. Whereas the software & services segment is anticipated to register a significant growth rate from 2023-2028. This is attributed to the adoption of treatment planning softwares allowing more precise and optimized radiation dose delivery. On the basis of technology, the radiotherapy market is segmented into external beam radiotherapy (further divided into linear accelerators, particle therapy systems, and conventional cobalt-60 teletherapy units, internal beam radiotherapy/brachytherapy (further segmented into seeds, applicators, after loaders, and IORT systems), and systemic radiotherapy products (including includes iobenguane (I-131), samarium-153, rhenium-186, and other radioisotopes (Yttrium-90, Radium-223, Phosphorous-32, and Radio-labelled antibodies, among others). In 2022, linear accelerators, a sub-segment of external beam radiotherapy segment accounted for the largest market This is attributed to the increased capabilities of LINAC in delivering effective radiation dosage, growing usage of LINAC across developed and developing nations, growing awareness about the advancements associated with LINAC systems. Based on end user, the radiotherapy market has been segmented into hospitals and independent radiotherapy centers. The hospitals segment accounted for the largest share of the radiotherapy market in 2023. This is attributed to the rising number of cancer patients undergoing radiotherapy treatment in hospitals and budget allocation implemented government in developing nation with an aim to enhance healthcare infrastructure, including the upgrading of radiotherapy equipment in hospitals. The global radiotherapy market is segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest share of the radiotherapy market in 2022, followed by Europe. The larger share of North America is attribute to the strong adoption of advanced radiotherapy technology, presence of market players and favorable reimbursement policy in the region. The radiotherapy market in Asia Pacific is anticipated to experience significant growth opportunities in coming years owing to the government support for the development and commercialization of advanced radiotherapy devices , increased healthcare infrastructure, and rising number of cancer patients propelling demand for radiotherapy services across Asia Pacific Countries the radiotherapy market was dominated by Siemens Healthineers AG (Germany), Varian Medical Systems, Inc. (US), Elekta (Sweden) Accuray Incorporated (US), IBA (Belgium), ViewRay Technologies, Inc. (US), Hitachi Ltd. (Japan), iCAD, Inc. (US), IsoRay, Inc. (US), , among others. Recent Developments of Radiotherapy Industry In October 2023, Accuray incorporated received approval of Tomo C radiation therapy system by the Chinese National Medical Products Administration (NMPA). In July 2023, IBA entered into partnership with Apollo Proton Cancer Centre (APCC) (India) to provide training to Oncologist on proton beam therapy In April 2022, Elekta and GE Healthcare entered into a global commercial collaboration agreement in the field of radiation oncology, enabling them to provide hospitals a comprehensive offering across imaging and treatment for cancer patients requiring radiation therapy

-

As a leading provider of customized services, Creative Biolabs devotes to the development of T cell therapy, such as T cell receptor (TCR) gene therapy. Through altering the specificity of T cell receptors (TCR), T cells can be genetically modified to enhance their tumor-killing activity, which is considered as a fascinating approach. Undoubtedly, Creative Biolabs offers products and services for T cells modified by TCR. Learn more about TCR Design Construction and Plasmid GLP Production: https://www.creative-biolabs.com/immuno-oncology/tcr-design-construction-and-plasmid-glp-production.htm