324 results found | searching for "banking"

-

Why Banks and Financial Services Need an ERP Software? A report says that around 50% of finance teams still spend over a week finalizing their books. Microsoft Dynamics 365 for Financial Services can help you with this and more. It’s smarter, faster, and way more secure than traditional systems. These solutions let you handle tons of data, keep up with government regulations, and serve your customers better. It’s an operational backbone for finance, procurement, controls, and reporting, complementing but not replacing core banking or trading systems. https://dnetsoft.com/blog/why-banks-and-financial-services-need-an-erp-software/

-

Maximizing Operational Efficiency in Financial Services with Dynamics 365 In today’s competitive financial landscape, banks and non-banking financial institutions (NBFIs) are under constant pressure to deliver faster services, maintain strict compliance, and manage growing operational costs. https://medium.com/@dynamicnetsoft/maximizing-operational-efficiency-in-financial-services-with-dynamics-365-e4d7daadbbc9

-

The NBFC Advantage: Unified Finance & Investment Management in Dynamics 365 The financial landscape is constantly shifting, presenting unique challenges and opportunities for Non-Banking Financial Companies (NBFCs) and other organizations managing significant investment portfolios. https://medium.com/@dynamicnetsoft/the-nbfc-advantage-unified-finance-investment-management-in-dynamics-365-4107215ab9d6

-

ISO Certification for Banking and Finance Industry ISO certification helps banking and the Finance Industry improve security, efficiency, and customer trust by aligning their processes with internationally recognized standards. ✅Enhanced Security ✅Build Trust ✅Global Recognition Learn More: https://sqccertification.com/banking-and-finance-industry/ Visit Site: https://sqccertification.com/ Call Us: +91-9990747758 Location: https://g.co/kgs/aJsxrjf #ISO #ISOIndia #ISOStandard #Sqccertification #Banking and Finance

-

You're finalizing your month-end reports, and just when things seem on track, QuickBooks throws an error — halting everything. That one glitch, like QuickBooks Error OLSU 1013 can waste hours. Let’s fix that together with clear steps in this guide. The error tends to be a banking error that shows up when there are inactive accounts, network instability, outdated settings, or damaged company files. The QuickBooks online software lets you to directly link the bank accounts, but when there are some issues, then it might show up in QuickBooks error OLSU 1013. Read More: https://www.hostdocket.com/quickbooks-error-olsu-1013/

-

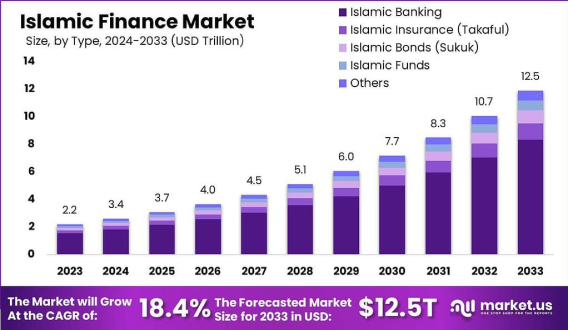

Islamic Finance Market size is expected to be worth around USD 12.5 Trillion The Islamic Finance Market size is expected to be worth around USD 12.5 Trillion By 2033, from USD 2.2 Trillion in 2023, growing at a CAGR of 18.4% during the forecast period from 2024 to 2033. In 2024, MEA held a dominant market position, capturing more than a 53.4% share, holding USD 1.1 Trillion revenue. Read more - https://market.us/report/islamic-finance-market/ The Islamic Finance Market refers to the global ecosystem of financial services and products that adhere to Sharia, the Islamic legal framework. It’s built on principles like prohibiting interest (riba), avoiding excessive uncertainty (gharar), and steering clear of investments in sectors like gambling or alcohol. This market includes a range of offerings such as Islamic banking, sukuk (Islamic bonds), takaful (Islamic insurance), and Islamic funds. It’s a dynamic sector, appealing not just to Muslim populations but also to those seeking ethical, socially responsible financial solutions. The market’s growth is fueled by its alignment with values like fairness, risk-sharing, and transparency, making it a compelling alternative to conventional finance in today’s world. The Islamic Finance Market size is massive and growing fast, with estimates suggesting it could hit over USD trillion by the early s, driven by a robust compound annual growth rate. It’s heavily concentrated in regions like the Middle East, North Africa, and Southeast Asia, with countries like Saudi Arabia, Malaysia, and the UAE leading the charge. Islamic banking dominates, holding around % of the market’s assets, while sukuk issuance is picking up steam globally. The market’s appeal spans beyond Muslim-majority nations, with places like the UK and Canada seeing growing demand for Sharia-compliant products. It’s a sector that’s not just about finance but about aligning money with moral and ethical values.

-

Safeguarding the Financial Sector Through Compliance Technology The global Anti-Money Laundering (AML) Software Market has achieved substantial growth, reaching a size of USD 2.6 billion in 2023. This surge is driven by increasingly stringent regulatory frameworks, a spike in financial fraud cases, and the ongoing digitization of banking and financial services. Looking forward, the market is poised for remarkable expansion, projected to attain USD 10.3 billion by 2033. This reflects a robust CAGR of 14.8% between 2024 and 2033. Financial institutions are investing in AML solutions to ensure compliance, improve risk management, and prevent illicit financial activity. for more insights- https://market.us/report/anti-money-laundering-software-market/

-

https://www.smartkeeda.com/latest-government-jobs Looking for the most recent updates on government job openings in 2025? Smartkeeda brings you a dedicated page that features the latest government jobs across India, including UPSC, SSC, Banking, Railway, State PSCs, and more. Get real-time alerts on upcoming vacancies, exam notifications, eligibility criteria, important dates, and application links—all in one place. Whether you're a fresh graduate or an experienced candidate, never miss an opportunity with Smartkeeda's trusted govt job alerts.

-

Global Micro Lending Market size is at a CAGR of 11.00% The Global Micro Lending Market size is expected to be worth around USD 588 Billion By 2034, from USD 207.1 Billion in 2024, growing at a CAGR of 11.00% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific led the global micro-lending market with over 45% share and USD 93.1 billion in revenue. China alone contributed USD 30.5 billion, growing at a CAGR of 8.2%, fueled by demand from small businesses and individuals. Read more - https://market.us/report/micro-lending-market/ The Micro Lending Market refers to a specialized segment of financial services where small loans, typically provided without collateral, are offered to individuals or small businesses that lack access to traditional banking services. This market plays a crucial role in promoting financial inclusion, particularly in underserved regions. It is often driven by microfinance institutions, fintech companies, and non-banking financial corporations that focus on empowering low-income populations, entrepreneurs, and women-owned businesses. As of now, the market is experiencing strong upward momentum, thanks to growing awareness about the importance of inclusive finance and the rise of digital platforms. One of the top driving factors behind the growth of the micro lending market is the rising demand for accessible credit options in developing regions. Many individuals still operate outside the formal financial system, and micro lending offers them a lifeline. Additionally, the increasing penetration of mobile phones and internet connectivity has made it easier for lenders to reach remote borrowers, further propelling market expansion.

-

https://testzone.smartkeeda.com/test/dashboard/sbi-cbo-mock-test/434 Prepare smarter for the SBI Circle Based Officer (CBO) exam with Smartkeeda’s expertly designed mock tests. Each test mirrors the actual exam pattern, covers the latest syllabus, and helps you build speed, accuracy, and confidence. Key Features: Real exam-like interface for better familiarity Section-wise coverage: Reasoning, English, Banking Awareness, and Computer Aptitude Detailed solutions with smart explanations Performance analysis with time comparison, accuracy stats, and ranking Based on the latest SBI CBO exam pattern Whether you're a first-time test taker or aiming to improve your score, Smartkeeda’s SBI CBO Mock Tests give you the edge you need to succeed. Practice smart, track your progress, and crack the exam with confidence.