296 results found | searching for "conventional"

-

The Smart Insulin Pens Market size was valued at USD 877.26 million in 2024 and is forecasted to more than double, reaching USD 1,818.89 million by 2032. This expansion reflects a compound annual growth rate (CAGR) of 9.57% during the forecast period of 2025 to 2032. The market’s rise is being fueled by a combination of advancing medical technologies, an increasing diabetes patient population, and the growing preference for digital, patient-centric healthcare solutions across the globe. Diabetes Management in a Digital Age Diabetes is one of the fastest-growing chronic health conditions worldwide, with the International Diabetes Federation reporting that more than 500 million people are currently living with the disease. Traditional insulin delivery methods, such as standard pens and syringes, often lack precision and convenience. This gap is increasingly being filled by smart insulin pens, which combine the reliability of conventional devices with modern digital features, including Bluetooth connectivity, dose tracking, and integration with mobile apps. These innovations not only reduce the risk of dosing errors but also provide patients and healthcare providers with valuable insights into insulin usage patterns. By recording, analyzing, and transmitting data seamlessly, smart pens are proving to be critical in improving adherence and outcomes in diabetes care. Read MOre: https://www.snsinsider.com/reports/smart-insulin-pens-market-7346

-

Dermocosmetics Market Market Size 2025 - Application, Trends, Growth, Opportunities and Worldwide Forecast to 2032 The global Dermocosmetics Market continues its upward trajectory, valued at USD 43.76 billion in 2024 and projected to reach USD 96.24 billion by 2032. According to recent industry analysis, the market is expected to grow at a compound annual growth rate (CAGR) of 10.37% during the forecast period of 2025–2032. This robust expansion highlights how consumer lifestyles, healthcare advancements, and rising awareness of skin health are reshaping the beauty and personal care industry. Dermocosmetics sit at the intersection of dermatology and cosmetics, offering scientifically formulated skincare solutions designed not only to enhance beauty but also to address specific skin concerns such as acne, hyperpigmentation, rosacea, and aging. Unlike conventional cosmetics, dermocosmetic products are rooted in clinical research, giving them higher credibility among dermatologists, healthcare providers, and consumers alike. Read More: https://www.snsinsider.com/reports/dermocosmetics-market-7357

-

Under the direction of a qualified therapist, animal-assisted treatment is a guided interaction between a person and a trained animal, most often a dog, cat, or even a horse. Petting an animal involves a guided interaction between a person and a trained animal, most often a dog or cat, as part of a well-planned treatment strategy designed to enhance emotional and mental health. The animal can assist individuals during sessions: Feel less anxious or stressed. Establish trust with the therapist. Share your feelings more freely. Cultivate concentration and tranquility. Feel unrestricted love and comfort. It’s incredible how being around a loving, kind animal may improve someone’s attitude and help them to feel safe. How does it work? Trained experts and licensed therapy animals head our animal-assisted therapy at The Luminous Care. Chosen for their mild nature, these animals are friendly, tranquil. While petting the dog, you can converse with your therapist, stroll outside together, or sit quietly. It’s all about what makes you feel better. For those who might find opening up in traditional counseling difficult, this kind of treatment is especially effective. Animals offer a calm, natural environment that lowers anxiety and anxiety. Spending time with a trusted buddy feels less like a therapy session. Who would benefit from this? For several people, including those with: Anxiety and depressive disorder Past trauma or PTSD Dependency and the requirements for recovery Social challenges or autism Low self-esteem Teens and young adults who may be anxious about conventional therapy will also benefit from this approach. Animal-Assisted Therapy at The Luminous Care Your healing process is designed to include comfort and connection by means of our program. The link between people and animals is unique, and we use that relationship to foster your spiritual, emotional, and mental development. You will never be pushed into anything. We present the animal slowly and at your speed if you’re unsure. Our aim is for your experience to be therapeutic, uplifting, and safe. Start Your Trip with Us. Proven therapeutic techniques are combined at The Luminous Care with innovative, encouraging programs like animal-assisted treatment. We think recovery is about the whole person — heart, mind, and spirit — and animals may play a major role in that healing. Call us right now to find out more about our animal-assisted therapy program in Florida if you’re ready to explore a gentle, caring, and organic approach to mental health. Visit us: https://theluminouscare.com/

-

Depression is a serious mental health disorder that impacts millions of people around the globe. While traditional treatments like antidepressants and therapy work for many, some individuals struggle with treatment-resistant depression. This is where ketamine for treatment-resistant depression comes in as a breakthrough therapy, offering hope to those who haven’t found relief through conventional methods. https://brainstim.ca/how-does-ketamine-therapy-help-in-depression-treatment/

-

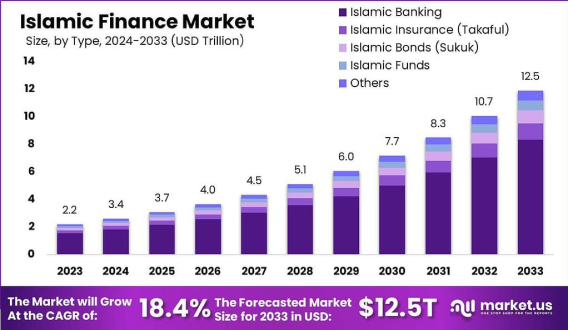

Islamic Finance Market size is expected to be worth around USD 12.5 Trillion The Islamic Finance Market size is expected to be worth around USD 12.5 Trillion By 2033, from USD 2.2 Trillion in 2023, growing at a CAGR of 18.4% during the forecast period from 2024 to 2033. In 2024, MEA held a dominant market position, capturing more than a 53.4% share, holding USD 1.1 Trillion revenue. Read more - https://market.us/report/islamic-finance-market/ The Islamic Finance Market refers to the global ecosystem of financial services and products that adhere to Sharia, the Islamic legal framework. It’s built on principles like prohibiting interest (riba), avoiding excessive uncertainty (gharar), and steering clear of investments in sectors like gambling or alcohol. This market includes a range of offerings such as Islamic banking, sukuk (Islamic bonds), takaful (Islamic insurance), and Islamic funds. It’s a dynamic sector, appealing not just to Muslim populations but also to those seeking ethical, socially responsible financial solutions. The market’s growth is fueled by its alignment with values like fairness, risk-sharing, and transparency, making it a compelling alternative to conventional finance in today’s world. The Islamic Finance Market size is massive and growing fast, with estimates suggesting it could hit over USD trillion by the early s, driven by a robust compound annual growth rate. It’s heavily concentrated in regions like the Middle East, North Africa, and Southeast Asia, with countries like Saudi Arabia, Malaysia, and the UAE leading the charge. Islamic banking dominates, holding around % of the market’s assets, while sukuk issuance is picking up steam globally. The market’s appeal spans beyond Muslim-majority nations, with places like the UK and Canada seeing growing demand for Sharia-compliant products. It’s a sector that’s not just about finance but about aligning money with moral and ethical values.

-

Is Steel the Best Choice for Warehouse Construction? Steel structures, particularly pre-engineered buildings (PEBs), have redefined the construction timeline. Unlike conventional buildings, PEBs are designed, fabricated, and assembled in a controlled environment before being shipped and installed on-site. This offsite process slashes construction time by up to 50%, a crucial advantage in today’s fast-paced industrial landscape. A reputable steel warehouse construction company can erect a fully functional warehouse in a fraction of the time it would take using traditional methods—without compromising on safety or durability. Read More: https://joripress.com/is-steel-the-best-choice-for-warehouse-construction

-

The Credit Score Trap: What Lenders Don’t Tell Homebuyers Buying a home? Your credit score is likely at the top of your mind. You may have heard that a good score means easy approval and better rates. But that’s not the whole story. Many homebuyers focus only on their score, not realizing the hidden factors that lenders consider. This can cause surprises when it’s time to close. The goal here? To uncover these secrets and help you make smarter moves for your mortgage. Understanding the Credit Score: Beyond the Basics What Is a Credit Score? Your credit score is a number lenders use to judge how risky you are. Common models are FICO and VantageScore. These scores range from 300 to 850, with higher scores indicating better credit. They are based on your credit report, which records your borrowing history. Factors like payment history, amounts owed, length of credit history, new credit, and types of credit all influence your score. The Role of Credit Scores in Homebuying Most lenders set minimum scores for different types of loans. For example, FHA loans might require a score of 580, while conventional loans often want 620 or higher. Better scores can open doors to lower interest rates, saving you thousands over the life of your loan. Statistics show that a higher credit score can secure a loan with a rate half a point lower than a bad score—meaning big savings and better terms. Common Misconceptions About Credit Scores Many believe that a perfect score guarantees the lowest rate. But that’s not true. Lenders look at more than just the number. You might have a high score but still struggle to get approved if other factors don’t check out. Also, scores aren’t set in stone. They can fluctuate based on recent activity or mistakes on your report. The Hidden Factors Lenders Don’t Highlight How Debt-to-Income Ratio (DTI) Affects Loan Eligibility Your debt-to-income ratio (DTI) compares your monthly debt payments to your gross income. Lenders love a low DTI because it shows you can handle payments. A DTI above 43% might make it hard to qualify—even if your credit score is good. For example, if you earn $5,000 a month but owe $2,500 on debts, your DTI is 50%, which is considered high. Managing your DTI can be the key to approval. Recent Credit Activity and Its Impact Lenders also watch your recent activity. Multiple credit inquiries in a short time can lower your score. Opening new credit accounts or applying for loans can signal financial stress. This may trigger suspicion, even if your credit score remains decent. Be cautious about new credit during the homebuying process. Credit Report Errors and How They Can Sabotage Your Efforts Reports often contain mistakes. Accounts mixed up with someone else, outdated info, or paid debts marked unpaid are common errors. These issues can unfairly lower your score or cause your application to be rejected. It’s smart to request a free credit report from the three bureaus—Equifax, Experian, and TransUnion—before starting the loan process. Dispute any mistakes you find. The Effect of Seasonal or Irregular Income Your income stability matters more than you think. If your paychecks vary wildly or you recently changed jobs, lenders might see you as a higher risk. Showing consistent income over time and providing proof of savings can help you present a stronger financial profile. Lender “Black Holes”: What Isn’t Disclosed The Influence of Non-Credit Factors Lenders consider many things outside your credit report. Your down payment size, employment history, and how much cash you have saved show your financial reliability. Making a larger down payment can sometimes compensate for a lower credit score. Similarly, a steady job history boosts confidence in your ability to repay. The Impact of Credit Score “Ranges” and Lender Policies Different lenders set their own cutoffs. FHA guidelines differ from banks’ internal policies. Some might be more flexible, while others have strict limits. These hidden thresholds aren’t always clear upfront, which can trip up buyers who don’t ask the right questions. Hidden Fees and Rate Adjustments Lenders may modify your rate based on factors they don’t openly share. For example, they could add fees or increase your interest rate if your credit profile is slightly below their preferred threshold. Comparing multiple offers helps you spot these hidden costs. Practical Strategies to Improve Your Chances Building and Maintaining Healthy Credit Start early. Pay all bills on time, keep your balances low, and avoid opening many new accounts at once. Request your credit reports regularly to spot errors. Small actions today can boost your score before applying. Preparing Your Financial Profile Reduce debt payments to lower your DTI. Save for a larger down payment and keep a comfortable emergency fund. When talking to lenders, highlight your stability and savings. Sharing good financial habits can sometimes offset minor credit issues. Negotiating and Choosing the Right Lender Ask questions about their approval criteria. Do they consider income stability or savings more than your credit score? Shop around. Different lenders treat the same profile differently. Comparing offers can get you better terms. Leveraging Professional Help If your credit is less-than-perfect, seek a credit counselor or mortgage broker. Pros understand hidden criteria and can guide you through the process. They might suggest ways to improve your profile quickly or find lenders willing to overlook minor issues. Conclusion Your credit score is a vital piece of the homebuying puzzle, but it’s just one part. Many factors influence whether you get approved and at what rate—factors lenders don't always share openly. Being aware of these hidden truths puts you in control. By managing your credit, reducing debt, and shopping smart, you can avoid falling into the credit score trap. The more you understand, the better your chances of securing that dream home with favorable terms. Take charge of your financial future today and move closer to homeownership with confidence. Visit my webpage for Instant Home Cash Offer

-

Saudi Arabia Smart Lighting Market: What to Know The Saudi Arabia smart lighting market size growth. Conventional lighting generally consumes excessive energy and lack efficiency. This further causes higher electricity costs and a greater environmental impact. With capabilities like dimming and occupancy sensing the smart lighting can significantly optimize energy consumption. Fore more info:- https://linqto.me/n/saudi-arabia-smart-lighting-market

-

Egypt LED Lighting Market: Why is It Better than Conventional Lamp? The growing need for energy-efficient lighting solutions along with a notable drop in its prices are a key driver of Egypt LED lighting market. Furthermore, increasing urbanization and the surge in modern housing developments are boosting the adoption of LED lighting solutions. Fore more info:- https://www.nairaland.com/8354714/uk-electronics-sales/2#134605508

-

A holistic wellness center offers a comprehensive approach to health, focusing on natural and effective treatments for various conditions, including those related to pelvic health and overall well-being. Many individuals seek pelvic health specialists to address issues like chronic pain, incontinence, or muscle dysfunction, while others turn to a pelvic floor specialist for targeted therapy that strengthens and restores core stability. For men experiencing performance concerns, innovative erectile dysfunction solutions provide non-invasive, drug-free options that promote long-term healing rather than just symptom relief. One of the most sought-after therapies today is red light therapy near me, which has been gaining attention for its ability to reduce inflammation, promote cellular regeneration, and accelerate healing across multiple health concerns. As part of the healing revolution, many people are moving away from conventional treatments and embracing alternative therapies that focus on the root cause of issues rather than just masking symptoms. By integrating advanced techniques like biofeedback, infrared light, and myofascial release, holistic centers are redefining healthcare and empowering individuals to take control of their health in a more natural, effective way. https://www.iveerestorativecare.com/