307 results found | searching for "funds"

-

How ERP Software Simplifies Multi-Entity Investment Portfolio Management? Investment portfolio management software is becoming an important tool in modern investment operations. Managing multiple funds, SPVs, and holding companies often means handling disconnected systems and scattered ledgers. An investment portfolio management solution addresses these pain points with powerful features that support multi-entity, intercompany, currency, and consolidation capabilities. https://dnetsoft.com/blog/how-erp-software-simplifies-multi-entity-investment-portfolio-management/

-

Finding International-Friendly AIF Registration Consultant? For funds raising foreign capital, ASC Group acts as your AIF registration consultant, aligning filings with FEMA and SEBI. Contact info@ascgroup.in or call +91-9999043311. For more:- https://www.ascgroup.in/taxation-regulatory-services/regulatory-services/aif-registration-sebi-india #GlobalFunds #ASCGroup #AIFExperts #MarketSecure

-

Are you a homeowner in Texas looking to tap into your home equity without having to make monthly mortgage payments? Consider a reverse mortgage in Texas as a way to access funds for retirement or other financial needs. At Open Mortgage, we specialize in helping Texas homeowners navigate the reverse mortgage process and find the best solution for their unique situation. Visit our website to learn more about reverse mortgages in Texas today! https://opfunding.com/reverse-mortgages/

-

Finding AIF Registration Consultant for Category II Funds? ASC Group specializes as an AIF registration consultant for Category II setups, from structuring to SEBI queries. Contact info@ascgroup.in or call +91-9999043311. For more:- https://www.ascgroup.in/taxation-regulatory-services/regulatory-services/aif-registration-sebi-india #CategoryII #ASCGroup #AIFRegistrationConsultant #MarketReady

-

ASC Group assists growing businesses in raising funds via SME IPOs. Their team ensures SEBI compliance, handles disclosures, and helps you attract the right investors. For more:- https://www.ascgroup.in/sme-ipo-bse-listing-consultant-advisory-readiness-service-firm-india/

-

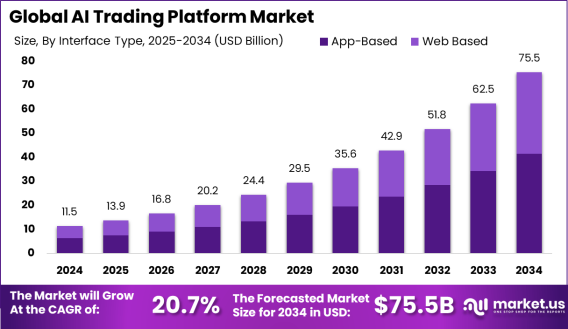

AI Trading Platform Market size is expected to be worth around USD 75.5 Billion The Global AI Trading Platform Market size is expected to be worth around USD 75.5 Billion By 2034, from USD 11.5 billion in 2024, growing at a CAGR of 20.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.2% share, holding USD 4.2 Billion revenue. Read more - https://market.us/report/ai-trading-platform-market/ An AI trading platform market refers to the ecosystem of technologies, software, and services that leverage artificial intelligence to facilitate financial trading activities. These platforms use advanced algorithms, machine learning, and data analytics to automate trading processes, analyze market trends, and execute trades with precision. They cater to a wide range of users, from institutional investors like hedge funds to retail traders seeking accessible tools. The market encompasses cloud-based and on-premises solutions, mobile apps, and specialized tools for algorithmic trading, sentiment analysis, and risk management. It’s a dynamic space driven by the need for speed, accuracy, and efficiency in navigating complex financial markets. The AI trading platform market, in terms of its market landscape, is experiencing robust growth, with projections estimating its value to reach significant milestones in the coming years. Valuations vary across reports, but the consensus points to a multi-billion-dollar industry expanding at a healthy compound annual growth rate. This growth is fueled by increasing demand from both institutional and retail investors, particularly in North America, which holds a dominant share due to its advanced financial infrastructure and tech innovation hubs. The market is competitive, with major players investing in research and development to enhance platform capabilities, while startups focus on niche solutions like personalized trading strategies.

-

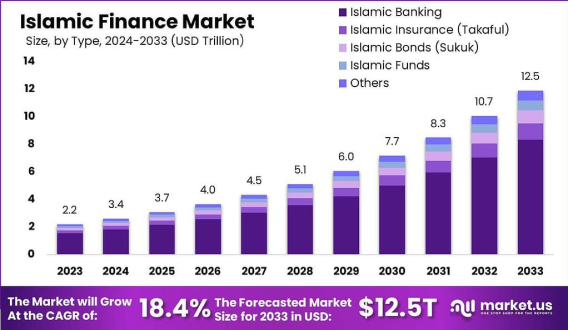

Islamic Finance Market size is expected to be worth around USD 12.5 Trillion The Islamic Finance Market size is expected to be worth around USD 12.5 Trillion By 2033, from USD 2.2 Trillion in 2023, growing at a CAGR of 18.4% during the forecast period from 2024 to 2033. In 2024, MEA held a dominant market position, capturing more than a 53.4% share, holding USD 1.1 Trillion revenue. Read more - https://market.us/report/islamic-finance-market/ The Islamic Finance Market refers to the global ecosystem of financial services and products that adhere to Sharia, the Islamic legal framework. It’s built on principles like prohibiting interest (riba), avoiding excessive uncertainty (gharar), and steering clear of investments in sectors like gambling or alcohol. This market includes a range of offerings such as Islamic banking, sukuk (Islamic bonds), takaful (Islamic insurance), and Islamic funds. It’s a dynamic sector, appealing not just to Muslim populations but also to those seeking ethical, socially responsible financial solutions. The market’s growth is fueled by its alignment with values like fairness, risk-sharing, and transparency, making it a compelling alternative to conventional finance in today’s world. The Islamic Finance Market size is massive and growing fast, with estimates suggesting it could hit over USD trillion by the early s, driven by a robust compound annual growth rate. It’s heavily concentrated in regions like the Middle East, North Africa, and Southeast Asia, with countries like Saudi Arabia, Malaysia, and the UAE leading the charge. Islamic banking dominates, holding around % of the market’s assets, while sukuk issuance is picking up steam globally. The market’s appeal spans beyond Muslim-majority nations, with places like the UK and Canada seeing growing demand for Sharia-compliant products. It’s a sector that’s not just about finance but about aligning money with moral and ethical values.

-

Private Equity in Asia: Quadria Capital’s $1.07 Billion Fund Signals Healthcare Growth Quadria Capital’s Fund III builds on the firm’s successful track record from its previous funds. Strong exits from Funds I and II underscore Quadria’s investment acumen, operational expertise, and ability to return capital to investors reliably. This success strengthens Quadria’s position among the largest private equity firms in Asia focused on healthcare and supports its mission to drive scalable impact through strategic investments. Read More: https://joripress.com/private-equity-in-asia-quadria-capitals-107-billion-fund-signals-healthcare-g

-

Private Equity Funds Singapore: High-Growth Investment Opportunities with Quadria Capital Private Equity Funds Singapore have become a key driver of growth and innovation across Asia, and Quadria Capital is at the forefront of this transformation. ith Singapore emerging as a global financial hub, our private equity platform leverages this strategic location to support high-impact healthcare investments across emerging Asian markets. As a healthcare-focused private equity firm, we target opportunities that improve access to quality care, enhance healthcare delivery, and drive long-term value in underserved markets. With Singapore as our investment base, we bring global standards to local markets—empowering companies to scale responsibly and sustainably. Visit Us: https://quadriacapital.com/