123 results found | searching for "pipeline"

-

What impact can Salesforce Sales Cloud Services and Salesforce Sales Cloud Integration have on my sales process? Salesforce Sales Cloud Services empower your team with real-time insights, lead tracking, and sales automation. Through effective Salesforce Sales Cloud Integration, businesses can unify CRM data, third-party tools, and communication platforms—enabling smarter lead scoring, opportunity management, and pipeline forecasting. Custom dashboards and AI-powered recommendations help sales reps prioritize tasks and close deals faster. For businesses aiming to streamline workflows and boost revenue, this integration brings visibility and control across every stage of the sales cycle. Visit us at- https://webkul.com/salesforce-sales-cloud-services/

-

At ClickIT, we offer DevOps outsourcing services focused on optimizing workflows and enhancing collaboration across your teams. Our experts bring in deep AWS knowledge, automation strategies, and agile methods to support faster releases and reduce downtime. Partner with us to modernize your delivery pipeline effortlessly. https://www.clickittech.com/devops-outsourcing/?utm_source=referral&utm_medium=backlinks&utm_campaign=rk

-

Salesforce Revenue Intelligence – Make Forecast Smarter Unlock smarter selling with Salesforce Revenue Intelligence—a powerful solution that combines AI-driven forecasts, real-time pipeline insights, and embedded analytics directly within Sales Cloud. Empower your sales teams to make faster, data-backed decisions, identify risks early, and uncover new opportunities effortlessly. Boost productivity and drive predictable growth by aligning sales strategy with real-time performance visibility—all in one place. https://goo.su/jiQuS

-

Online FREE DEMO On azure data engineer course How to Build a Data Pipeline in Azure Data Factory! Watch our step-by-step guide. Join Now: https://meet.goto.com/627041781 Attend Online #FreeDemo On #AzureDataEngineering by Mr. Siddharth. Demo on: 19/10/2024 @9:00 AM IST Contact us: +91 9989971070. Visit: https://www.visualpath.in/online-azure-data-engineer-course.html

-

Struggling with sales forecasting and pipeline management? Salesforce Sales Analytics offers actionable insights to help you streamline your sales process and drive revenue growth. With powerful data visualization and reporting, you can make informed decisions, optimize performance, and spot opportunities to boost your sales strategy. Enhance your team's efficiency and close deals faster by leveraging the full potential of Salesforce Sales Analytics. https://thesalesforcefirst.com/salesforce-sales-analytics-tool/

-

Respiratory Syncytial Virus Vaccine & Antibody Pipeline Market The latest report by Precision Business Insights, titled respiratory syncytial virus vaccine and antibody pipeline market covers complete information on market size, share, growth, trends, segment analysis, key players, drivers, and restraints.

-

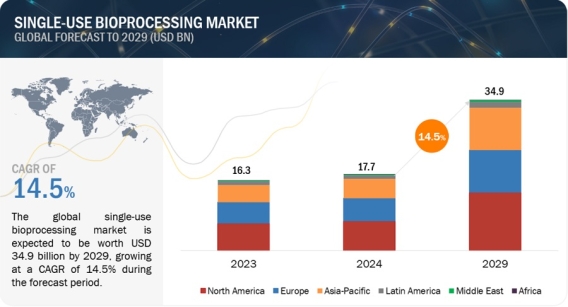

Global Single Use Bioprocessing Market Worth $34.9 Billion by 2029: Key Insights and Analysis https://www.marketsandmarkets.com/Market-Reports/single-use-bioprocessing-market-231651297.html The single-use bioprocessing market is expected to grow at a CAGR of 14.5% during the forecast period. The market is estimated to be around USD 17.7 billion in 2024 and is projected to reach USD 34.9 billion by 2029. Growing biologics & biosimilars market, need for low capital investment, a surge in single-use bioprocessing adoption among CDMOs & CMOs, and advantages such as increased productivity & reduced risk of cross contamination, are some factors responsible for the growth of the market. On the other hand, issues related to leachables & extractables, regulatory compliance, and discussions about PFAS restrictions are hampering the market growth. Download a PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=231651297 Based on products, the single-use bioprocessing market is segmented into equipment and consumables. The consumables segment accounted for the largest share and is also estimated to grow at the highest CAGR of the single-use bioprocessing market. This can be attributed to their repeated purchase, higher usage, frequent replacement, and broad application range. Based on application, the single-use bioprocessing market is segmented into cell culture, filtration, purification, mixing, storage & transfer, and other applications. The filtration segment accounted for the largest share of the single-use bioprocessing market. The large share of this segment can be attributed to the wide use of equipment for various filtration applications in the pharmaceutical industry, increased filtration requirements in the biopharmaceutical industry, and the higher requirement for these filters compared to consumables and filtration accessories. Based on workflow, the single-use bioprocessing market is segmented into upstream and downstream bioprocessing. The growth of the single-use bioprocessing market for upstream bioprocesses is driven by technological advancements and strategic collaborations between industry players. For instance, in June 2023, Culture Biosciences and Cytiva collaborated to introduce new bioprocess solutions that leverage digitization, in-silico approaches, and virtual monitoring and control of experiments. This collaboration revolutionized upstream processing by providing customers unprecedented access to cutting-edge technologies and methodologies, fueling the demand for advanced bioprocessing solutions. Based on molecule type, the single-use bioprocessing market is segmented into monoclonal antibodies (mAbs), vaccines, therapeutic proteins & peptides, and cell & gene therapies. mAbs accounted for the largest share of the single-use bioprocessing market. The large share is attributed to the increasing pharmaceutical R&D drug pipeline, increasing incidence of cancer, and rising usage & demand for cancer therapy. Based on the end user, the single-use bioprocessing market is segmented into pharmaceutical & biotechnology companies, academic & research institutes, and CMOs & CROs. In 2023, pharmaceutical & biotechnology companies accounted for the largest share of the single-use bioprocessing market due to their higher adoption of single-use bioprocessing equipment and consumables, the stringent regulatory scenario, increased R&D activities, increased production of biologics, and rising manufacturing of biologics and biosimilars in developed countries. Based on region, single-use bioprocessing market is segmented into six major regions including North America, Europe, Asia Pacific, Latin America, Middle East, and Africa. In 2023, North America dominated the single-use bioprocessing market. Europe held the second largest share followed by the Asia Pacific. The Asia Pacific market is expected to show the highest growth rate during the forecast period. Growing pharmaceutical R&D activities, increasing demand for biosimilars, significant investments by biopharmaceutical companies & CMOs in emerging Asia Pacific countries, are some of the factors contributing to the regional growth. Key players in the single-use bioprocessing market include Sartorius AG (Germany), Danaher Corporation (US), Thermo Fisher Scientific, Inc. (US), Merck KGaA (Germany), Avantor, Inc. (US), 3M Company (US), Repligen Corporation (US), Entegris (US), Getinge AB (Sweden), Parker Hannifin Corporation (US), Alfa Laval Corporate AB (Sweden), Saint-Gobain (France), Eppendorf SE (Germany), Corning Incorporated (US), Eaton Corporation plc (Ireland)v, METTLER TOLEDO (US), Porvair PLC (UK), Lonza (Switzerland), ABEC, INC. (US), NewAge Industries (US), PBS Biotech, Inc. (US), Sentinel Process Systems, Inc. (US), Meissner Filtration Products, Inc. (US), SATAKE MultiMix Corporation (Japan), Hamilton Company (US), Membrane Solutions (US), Cole-Parmer Instrument Company, LLC (US), Distek, Inc. (US), Esco Lifesciences Group Ltd. (US), and TECNIC Bioprocess solutions (Spain). Recent Developments of the Single Use Bioprocessing Industry: In April 2024, Cytiva introduced the Xcellerex magnetic mixer, a single-use mixing system in 2,000 and 3,000 L capacities for large-scale mAb, vaccine, and genomic medicine manufacturing processes. In April 2023, Merck KGaA launched the Ultimus single-use process container film designed to provide extreme durability and leak resistance for single-use assemblies used for bioprocessing liquid applications.

-

Innovations in Digital Diabetes Management: Transforming Patient Care https://www.marketsandmarkets.com/Market-Reports/digital-diabetes-management-market-144725893.html The global digital diabetes management market is projected to reach USD 35.8 Billion by 2028 from an estimated USD 18.9 Billion in 2023, at a CAGR of 13.6% during the forecast period. The growing number of people with diabetes has led to an increased focus on developing and adopting better diabetes care solutions. Advances in technology have made it possible to create more flexible and sophisticated solutions. The increasing use of cloud-based enterprise solutions and connected devices and apps are also driving market growth. However, high device costs, lack of reimbursement in developing countries, and the preference for traditional diabetes management devices are expected to slow market growth. Download a PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=144725893 The digital diabetes management market offers a wide range of devices, apps, data management software & platforms, and services. Smart glucose metres, continuous glucose monitoring (CGM) systems, smart insulin pens, smart insulin pumps/closed-loop systems, and smart insulin patches are included in the devices segment. Similarly, the digital diabetes management apps segment is further sub-segmented into diabetes & blood glucose tracking apps and obesity & diet management apps. In 2022, the devices segment held the largest market share for digital diabetes management, with 76.4%. Factors such as the increasing demand for wireless and wearable devices for diabetes management, growing acceptance of smart insulin pumps & pens for insulin delivery, and the growing awareness about continuous glucose monitoring in patients are driving the market growth. Different types of digital diabetes management device studied in the report are handheld devices and wearable devices. Among these, the The market for digital diabetes management devices in 2022 was dominated by wearables, with a share of 60.3%. By 2028, this market is expected to have grown from USD 8,876.3 million in 2023 to USD 18,557.3 million. Technology advancements like closed-loop pump systems, smart insulin patches, and other pipeline devices, as well as factors like the growing use of smart insulin pumps and insulin patches for self-insulin delivery in diabetes management, are all the factors that are boosting the wearable devices segment's growth.. Various end users of the digital diabetes management market are self/home healthcare, hospitals & specialty diabetes clinics, and academic & research institutes. The self/home healthcare accounted for the largest share of 79.9% of the digital diabetes management market in 2022. The large share of this segment can mainly be credited to technological advancements and a shift toward home care and self-management of diabetes. North America is estimated to grow at the highest CAGR during the forecast period. The region also accounted for the largest market share of 45.3%, followed by Europe with a share of 28.1% in 2022. Various factors attributing to the growth of the digital diabetes management market in North America are growing adoption of connected diabetes management devices, high adoption of diabetes management apps, growing demand for integrated hybrid closed-loop systems, favorable reimbursement policies, and government initiatives to promote digital health in the region. Furthermore, In Asia Pacific, countries such as China and India have a high prevalence rate of diabetes, primarily due to the increasing urbanization, population and lifestyle changes. The increasing incidence of diabetes, rising awareness, high undiagnosed population, and the rising penetration of smartphones and tablets have propelled the adoption of digital diabetes management solutions in the region. The prominent players operating in the global digital diabetes management market are Medtronic (Ireland), B. Braun Melsungen AG (Germany), Dexcom, Inc. (US), Abbott Laboratories (US), F. Hoffmann-La Roche (Switzerland), Insulet Corporation (US), Tandem Diabetes Care (US), Ascensia Diabetes Care Holdings AG (Switzerland), LifeScan, Inc. (US), Tidepool (US), AgaMatrix (US), Glooko, Inc. (US), DarioHealth Corporation (Israel), One Drop (US), Dottli (Finland), Ypsomed Holding AG (Switzerland), ARKRAY (Japan), ACON Laboratories, Inc. (US), Care Innovations, LLC (US), Health2Sync (Taiwan), Emperra GmbH E-Health Technologies (Germany), Azumio (US), Decide Clinical Software GmbH (Austria), Pendiq GmbH (Germany), and BeatO (India). Recent Developments of Digital Diabetes Management Industry In February 2023, Dexcom launched Dexcom G7 CGM device in the US and is planning to launch in Europe and Asia Pacific by first quarter of 2024 In October 2022, Abbott laboratories launched Freestyle Libre 3 CGM device worldwide. In April 2022, Dexcom launched Dexcom ONE device. The company launched the new Dexcom ONE Continuous Glucose Monitoring System in the UK. In April 2022, Ascensia Diabetes Care Holdings AG (Switzerland) launched Eversense's 6-month CGM system in the US. In October 2021, LifeScan, Inc. (US) launched OneTouch Solutions. This is a holistic digital health offering linking people with diabetes to solutions and support from proven experts. In September 2020, Roche Diagnostics (Switzerland) launched a remote patient monitoring ssolution, which is a new element of the RocheDiabetes Care Platform and uses its pattern detection feature.

-

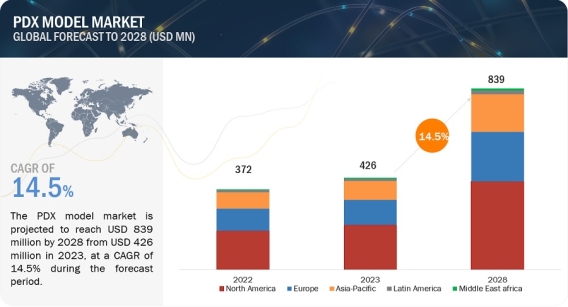

PDX Model Market Worth $839 Million: Opportunities and Challenges https://www.marketsandmarkets.com/Market-Reports/patient-derived-xenograft-model-market-121598251.html The PDX model market is projected to reach USD 839 million by 2028 from USD 426 million in 2023, at a CAGR of 14.5% during the forecast period. The key factors driving the growth of the global patient-derived xenograft/ PDX model market are the enhanced preclinical predictability, advancement of personalized medicine, and rise in the prevalence of cancer. However, ethical concerns surrounding the use of animal models along with high associated costs are expected to restrain market growth to a certain extent. Download a PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=121598251 The patient-derived xenograft/ PDX model market is categorized into five major categories: type, implantation method, tumor type, application, and end user. Based on type, the patient-derived xenograft/ PDX model market is segmented into mouse model and rat model. In 2023, the mouse model segment dominated the patient-derived xenograft/ PDX model market. Growth in this market segment can be attributed to biological similarities of the mice model with human tumors, and the availability of immunodeficient strains is expected to form the largest share segment in the patient-derived xenograft/ PDX model market. Based on implantation method, the market is categorized into subcutaneous implantation, orthotopic implantation, and other implantation methods. In 2023, the subcutaneous segment accounted for the largest share of the patient-derived xenografts/ PDX models market. The major drivers are propelling the accessibility and ease of Implantation of the subcutaneous method and the cost and time efficiency of the method. Based on tumor type, the patient-derived xenograft/ PDX model market is categorized into gastrointestinal tumor models, gynecological tumor models, respiratory tumor models, urological tumor models, hematological tumor models, and other tumor models. The hematological tumor models segment accounted for the fastest-growing segment of the tumor type segment of the patient-derived xenograft/ PDX model market. Market growth can largely be attributed to factors such a continuous rise in the incidence of hematological malignancies which is supporting research of treatments against hematological malignancies, and a growing focus on targeted therapies against cancer among others. Based on application, the patient-derived xenograft/ PDX model market is segmented into preclinical drug development, biomarker analysis, translational research, and biobanking. Among these, the preclinical drug development application segment accounted for the largest share of the patient-derived xenografts/ PDX models application market. The major driver fueling the growth of the patient-derived xenografts/ PDX models market is a constant increase in the number of ongoing clinical trials and the use of PDX models in the development of personalized therapeutic regimens for oncology treatments. Based on the end user, the segment is categorized into pharmaceutical & biotechnology companies, contract research organizations (CROs), and academic & research institutions. In 2023, the pharmaceutical and biotechnology companies segment dominated the end-user segment with the highest revenue share. Collaborative projects amongst the pharmaceutical and biotechnology companies, rising numbers of drugs in the R&D pipeline, and increasing investment in R&D are propelling the growth of the pharmaceutical and biotechnology companies market. Based on region, North America accounted for the largest share of the patient-derived xenografts/ PDX models market. The large share of the North American region can be attributed to extensive research focusing on novel oncology therapies, a rise in cancer prevalence, and increased adoption of personalized medicine. Moreover, the APAC region offers lucrative growth potential for the PDX models market. This can be attributed to the supportive regulatory framework, ongoing expansion and modernization of healthcare infrastructure across emerging Asian countries, and public-private initiatives to encourage awareness about personalized medicine. Major players operating in the patient-derived xenograft/ PDX model market include JSR Corporation (Japan), Wuxi Apptec (China), The Jackson Laboratory (US), Charles River Laboratories International, Inc. (US), Taconic Biosciences, Inc. (US), Oncodesign Precision Medicine (France), Inotiv, Inc. (US), Pharmatest Services (Finland), Hera BioLabs (US), EPO Berlin-Buch GmbH (Germany), Xentech (France), Urosphere (France), Altogen Labs (US), Abnova Corporation (US), Genesis Biotechnology Group (US), Biocytogen Pharmaceuticals Co., Ltd. (China), Creative Animodel (US), BioDuro-Sundia (US), Aragen Life Sciences (India), Shanghai LIDE Biotech Co., Ltd. (China), Certis Oncology Solutions (US), InnoSer (Netherlands), IVRS AB (Sweden), Beijing IDMO Co. Ltd. (China), and Shanghai Chempartner Co. Ltd. (China). Recent Developments in PDX Model Industry In December 2022, Crown Bioscience, Inc., a subsidiary of JSR Life Sciences, entered into a worldwide licensing agreement with ERS Genomics Limited. This agreement granted Crown Bioscience complete global access to ERS's foundational CRISPR/Cas9 patent portfolio, enabling the company to utilize CRISPR/Cas9 for genetic editing on a global scale. Under the provisions of this agreement, Crown Bioscience broadened its capabilities in genetic manipulation. The company is exploring the potential of gene editing within three-dimensional models of patient-derived tumor organoids. In July 2022, GemPharmatech entered into a strategic licensing arrangement with Charles River Laboratories, Inc. This partnership entails the exclusive distribution rights for GemPharmatech's advanced NOD CRISPR Prkdc Il2r gamma (NCG) mouse lines within the North American region. In November 2021, Inotiv announced the completion of the acquisition of Envigo RMS Holding Corp., a leading global provider of research models and services.

-

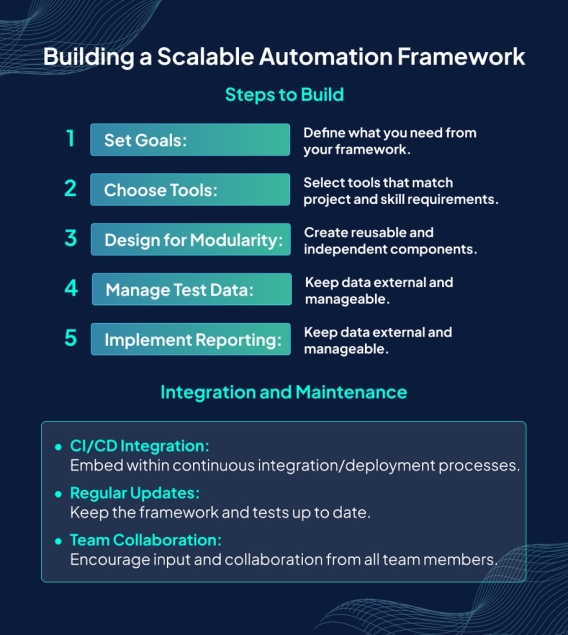

Hey QA enthusiasts! Ready to take your automation skills to the next level? Here’s a quick guide on how to build a scalable automation framework that will make your testing process efficient and robust! - Define Your Goals Understand what you need to achieve with your automation framework. Set clear objectives for scalability, maintainability, and efficiency. - Choose the Right Tools Select tools and technologies that fit your project requirements. Popular choices include Selenium, Appium, and Cypress. - Modular Architecture Design your framework with modularity in mind. Break down tests into reusable components to enhance maintainability and scalability. - Robust Reporting Implement detailed and customizable reporting to quickly identify issues and track test performance over time. - Continuous Integration (CI) Pipeline Integrate your framework with a CI pipeline to ensure tests are run automatically and consistently. - Version Control Use a version control system (like Git) to manage your test scripts and collaborate with your team seamlessly. - Scalable Test Data Management Manage test data efficiently to ensure consistency and scalability across different environments. Building a scalable automation framework takes time and effort, but the benefits are immense! Boost your productivity and ensure high-quality software with these tips. Happy testing! Learn more >> https://www.syntaxtechs.com/blog/scalable-automation-frameworks/