842 results found | searching for "credit"

-

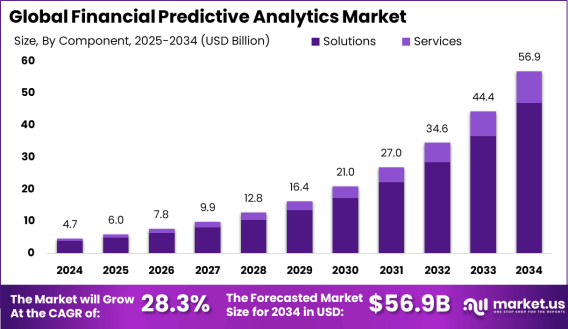

Financial Predictive Analytics Market size is expected to be worth around USD 56.9 BN The Global Financial Predictive Analytics Market size is expected to be worth around USD 56.9 Billion By 2034, from USD 4.7 billion in 2024, growing at a CAGR of 28.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34.1% share, holding USD 1.6 Billion revenue. Read more - https://market.us/report/financial-predictive-analytics-market/ Financial Predictive Analytics Market refers to the specialized area within financial services where advanced statistical techniques and machine learning models are used to forecast future financial trends. These forecasts help institutions better manage risks, allocate assets, and identify growth opportunities. This market plays a critical role in supporting smarter, data-driven decision-making processes for banks, investment firms, insurance providers, and regulatory bodies by turning raw data into actionable insights. The Financial Predictive Analytics Market is gaining momentum as financial institutions increasingly rely on predictive tools to stay competitive and resilient in a rapidly evolving economic environment. With rising demand for real-time risk assessment and personalized financial services, firms are investing heavily in predictive analytics platforms. Financial organizations are no longer just looking for historical reporting but also want foresight, which these tools now deliver with improved accuracy thanks to recent advancements. One of the main drivers of adoption is the surge in availability of big data combined with the need to make precise, forward-looking financial decisions. Technologies such as artificial intelligence, cloud computing, and advanced data visualization tools are being rapidly integrated into predictive systems. Organizations see value in predictive analytics for enhancing fraud detection, improving credit scoring, optimizing trading strategies, and streamlining operations, which has significantly boosted its demand.

-

You could believe tenant screening is only something landlords use to check on you when you hear the words. But here’s the reality: tenant screening safeguards your as a renter in addition to your property. We at Prime Property Management feel a thorough screening process is where a secure, clean, stress-free rental experience begins. It’s not about assessing people; it’s about fostering a welcoming environment for all. What is Tenant Screening? Tenant screening is the process of examining a potential renter’s background prior to their move-in. Landlords (or a property manager for rental houses such as ours) consider issues like: · Your payment history and credit score · References from prior landlords on rentals · Income and employment history · Any past legal matters or evictions Though it doesn’t sound as terrifying as it is. Most renters who consistently pay rent, maintain their space spotless, and abide by regulations have nothing to be concerned about. How It Benefits Renters as Well Though it might seem like tenant screening is only for landlords, renters also profit greatly. Thus it goes: 1. Less Dangerous Communities You may feel more safe in your house when everyone goes through the same screening. You are less prone to experience trouble with loud neighbors, dangerous conduct, or property damage. 2. Improved House Conditions Usually, landlords who pay attention to who they lease to also care about the house. That means faster maintenance, cleaner shared spaces, and more respect for the neighborhood. 3. Honest Renting Procedure Everyone is treated equally when a skilled property management company is engaged. All applicants follow the same guidelines; decisions are founded on facts, not emotions. 4. Long-term Consistency Fewer people move in and out when good tenants are selected. Less noise, more friendly neighbors, and a more stable living environment for everyone result. Expectations from Prime Property Management Our rental management services include tenant screening so we can provide a welcoming environment for all. We’re here to assist you in locating excellent fit tenants who desire a house they can enjoy rather than to judge. Should you apply with us, well we’ll keep everything open, honest, and straightforward. Our responsibility is to ensure a process simple, fast, and respectful. Last Ideas Though it might seem like tenants screening is only about preserving the property, it is also about safeguarding you and guaranteeing you are moving into a secure, well-managed home. You become part of a community that values respect, trust, and peace of mind with Prime Property Management not only a tenant. https://www.primepropertymanagement.org/

-

Catch-Up Bookkeeping: Regain Control of Your Finances Keeping financial records accurate and up to date is essential for any business—but when transactions pile up, it can feel overwhelming to make sense of it all. That’s where bookkeeping catch-up services come in. Whether it’s a few months or several years of records, catching up doesn’t have to be stressful or time-consuming. At StratEdge TaxAcc, we specialize in Clean-Up and Catch-Up bookkeeping services tailored to help businesses regain clarity and confidence in their financial data. Our team dives deep into your existing records, uncovers discrepancies, and organizes everything for full transparency. We ensure every entry is accurate and compliant with your tax obligations. Our approach goes beyond basic data entry. We analyze your previous transactions, reconcile bank and credit card accounts, and make necessary corrections to give you a clean and complete financial foundation. This is especially helpful before audits, tax filing, or business planning. Working with our experts gives you peace of mind. You’ll get a clear picture of your business’s financial position, make informed decisions, and avoid unnecessary penalties. No matter the backlog, we bring your books back into order quickly and professionally.

-

I quite like reading an article that can make people think. Also, thanks for allowing for me to comment! https://nirrtigo.blogspot.com/2015/05/Landlords-rights-and-Precautions-before-renting-out-your-property-in-India.html?sc=1749618826120#c5014322868473219216 https://nonprofitconversation.blogspot.com/2009/03/effectively-involving-your-members-in.html?sc=1749618906437#c7369852515334911208 https://obscurekidlitauthors.blogspot.com/2017/01/amazing-animals-and-where-to-find-out.html?sc=1749618961578#c209429067878749378 https://patbravodesign.blogspot.com/2018/03/pat-bravo-q-ask-me-anything-my-career.html?sc=1749618998514#c6017181286414946304 https://pgsqldeepdive.blogspot.com/2013/11/rds-for-postgresql.html?sc=1749619035451#c5176879360602791273 https://prawnsandprobability.blogspot.com/2012/04/how-fish-shoal-4-using-neural-network.html?sc=1749619161887#c2059466762230511150 https://raisedbygypsies.blogspot.com/2014/10/record-review-giant-claw-dark-web.html?sc=1749619224125#c4815085880854171545 https://ribbongirls.blogspot.com/2016/11/november-use-any-image-challenge.html https://rootedinthyme.blogspot.com/2015/02/create-cook-and-garden-and-simple-sweet.html?sc=1749619342337#c4774695636954828108 https://rustyroostervintage.blogspot.com/2012/12/red-tote-xmas-redo.html?sc=1749619520623#c4870780292565182699 https://scottsampson.blogspot.com/2013/07/nature-tip2-venture-into-bubble.html?sc=1749620430595#c1248560322287553721 https://splashdownpa.blogspot.com/2010/06/sucking-up-susquehanna.html?sc=1749620713952#c9222213555826732368 https://stylefromtokyo.blogspot.com/2013/04/on-streetdaimyofukuoka.html https://sustainabledecor.blogspot.com/2013/12/wordless-wednesday_18.html?sc=1749620847169#c4181307560542482748 https://swarnalidreams.blogspot.com/2014/07/spa-review-four-fountains.html?sc=1749620872870#c8063484105130979655 https://swissartspace.blogspot.com/2019/09/drawing-2019-call-for-artists.html?sc=1749620906889#c8258247912313355059 https://teamcolors.blogspot.com/2014/02/rose-valentine-heart-coloring-pages.html?sc=1749620938215#c3726688992668680673 https://tete-de-thon.blogspot.com/2012/04/tatouage-vous-me-ferez-8-pages.html?sc=1749621120046#c325496501199130822 https://thelonghorseride.blogspot.com/2019/04/i-am-now-published-author.html?sc=1749621171251#c2128192006448595058 https://thepinkpeonyoflejardin.blogspot.com/2010/12/chocolate-covered-pretzels-recipe.html?sc=1749621265986#c6257834970853782919 https://tracysbitsnpieces.blogspot.com/2017/01/rainbow-scrap-challenge-2017.html?sc=1749621292652#c8848384676973724500 https://traditionalwitchcraft.blogspot.com/2012/12/free-online-love-spells.html?sc=1749621324032#c7309864907422650014 https://upcycleus.blogspot.com/2014/07/upcycling-cardboard-into-ironman.html?sc=1749621374681#c3769972647747187403 https://usgbcblog.blogspot.com/2012/07/a-renewed-commitment-to-buildings-and.html?sc=1749621429456#c3134917167106553093 https://wff-yo.blogspot.com/2019/06/diploma-aniversara-colegilor-din.html?sc=1749621458054#c8277384907204034273 https://wonkysensitive.blogspot.com/2015/09/v-v-lazarus.html?sc=1749621497433#c7427514431029048982 http://www.blizzardhacks.com/2016/11/wow-updated-way-to-kill-other-players.html?sc=1749621528631#c4977258530644197091 http://www.fashionistanygirl.com/2016/03/now-trendingdestination-swimwear.html?sc=1749621595947#c2955658085779414204 http://www.humorrisk.com/oldblog/?entry=entry081106-161027&comments#comment250611-090125 http://www.readsallthebooks.com/2016/09/threat-by-tia-lewis-cover-reveal.html?sc=1749621761147#c3065787620181105883 http://www.somenotesonnapkins.com/2014/08/s-e-t-t-l-e.html?sc=1749621808364#c6182462199244992130 http://www.thecommroom.com/2014/10/tcr-on-broadway-interview-with-peter.html?sc=1749621836234#c4469753334665130009 http://www.thefreebiejunkie.com/2011/09/daily-deal-site-free-credit-round-up.html?sc=1749621922888#c8804979782815538385 https://www.thekipiblog.com/2016/01/food-colorful-eats-in-london-cabana-brasil?sc=1749621987319#c789512392036265365 http://www.throneout.com/2009/10/queen-and-vidal-sasson-exchange.html?sc=1749622028085#c395515882888692763 http://www.vanessaalvarado.com/2012/06/gifts-for-guys-thrifty-vintage-fathers.html?sc=1749622096745#c434080390932505120 https://zanzibarnikwetu.blogspot.com/2017/11/india-three-rape-10-year-old-for-months.html?sc=1749622123739#c3514584373219334662 https://youtubecreator-fr.googleblog.com/2021/03/postulez-lappel-projets-savoirs.html?sc=1749622707715#c551440161255339320 http://mortderire.blog.free.fr/index.php?post/2009/03/01/Four-rire-sur-le-plateau-de-R%C3%A9ussir-TV&pub=1#pr https://www.sasakitime.com/2012/07/twinkie-cupcake-recipe.html?sc=1749622903242#c3373434581189251382 https://razmatazblog.blogspot.com/2015/02/pink-rules.html?sc=1749622999321#c2711621364009270800 https://jcrewaficionada.blogspot.com/2021/06/the-great-weekly-exchange-looking-to_0760677019.html?sc=1749623108497#c4036842673497888386 https://filesharingshop.com/news/what-is-real-debrid-premium-membership http://www.kasiewest.com/2018/11/publishing-schedule.html?sc=1749623293739#c2749192235735987964 https://richestoragsbydori.blogspot.com/2013/01/steamed-shrimp-and-broccoli-with-rice.html?sc=1749623398306#c7991195861978452963 https://pomagam.pl/profil/raguveer-sharma https://storium.com/user/urgentemiratesvisa https://vimeo.com/user242035400 https://www.pozible.com/profile/raguveer-sharma https://www.checkli.com/urgentemiratesvisa https://jsfiddle.net/u/urgentemiratesvisa/fiddles/ https://d.cosx.org/u/urgentemiratesvisa http://kepeg.ar-raniry.ac.id/2015/12/uraian-tugas-bagian-organisasi-dan.html?sc=1749625724343#c3556961286689225570 http://blog.greenhousefabrics.com/2015/11/cleaning-codes.html?sc=1749625751015#c6812967944717606732 https://royalfancy36.blogspot.com/2021/10/what-is-online-developer-what-does-web.html?sc=1749625845172#c7642800311349196967 https://ysigoenlacocina.blogspot.com/2015/11/scones-receta-tradicional.html?sc=1749625929004#c5592490510624925503 https://vitaminnaracom.blogspot.com/2021/09/the-bfa-is-trade-association.html?sc=1749626029100#c1473010163256011830 https://masterenergy3.blogspot.com/2021/08/international-locations.html?sc=1749626066049#c8879854799283044832 https://sportsisolate.blogspot.com/2021/08/faculty-of-health-social-care-and.html?sc=1749626141263#c2356568753655857829

-

#BS7858 clearance checks help employers screen people working in sensitive or security-related jobs. This check covers criminal history, identity, credit, and employment records over the last five years. It meets UK industry standards and helps you stay compliant while protecting your business. https://www.ukemployeechecks.co.uk/employee-screening-packages/bs7858-security-checks/

-

The Credit Score Trap: What Lenders Don’t Tell Homebuyers Buying a home? Your credit score is likely at the top of your mind. You may have heard that a good score means easy approval and better rates. But that’s not the whole story. Many homebuyers focus only on their score, not realizing the hidden factors that lenders consider. This can cause surprises when it’s time to close. The goal here? To uncover these secrets and help you make smarter moves for your mortgage. Understanding the Credit Score: Beyond the Basics What Is a Credit Score? Your credit score is a number lenders use to judge how risky you are. Common models are FICO and VantageScore. These scores range from 300 to 850, with higher scores indicating better credit. They are based on your credit report, which records your borrowing history. Factors like payment history, amounts owed, length of credit history, new credit, and types of credit all influence your score. The Role of Credit Scores in Homebuying Most lenders set minimum scores for different types of loans. For example, FHA loans might require a score of 580, while conventional loans often want 620 or higher. Better scores can open doors to lower interest rates, saving you thousands over the life of your loan. Statistics show that a higher credit score can secure a loan with a rate half a point lower than a bad score—meaning big savings and better terms. Common Misconceptions About Credit Scores Many believe that a perfect score guarantees the lowest rate. But that’s not true. Lenders look at more than just the number. You might have a high score but still struggle to get approved if other factors don’t check out. Also, scores aren’t set in stone. They can fluctuate based on recent activity or mistakes on your report. The Hidden Factors Lenders Don’t Highlight How Debt-to-Income Ratio (DTI) Affects Loan Eligibility Your debt-to-income ratio (DTI) compares your monthly debt payments to your gross income. Lenders love a low DTI because it shows you can handle payments. A DTI above 43% might make it hard to qualify—even if your credit score is good. For example, if you earn $5,000 a month but owe $2,500 on debts, your DTI is 50%, which is considered high. Managing your DTI can be the key to approval. Recent Credit Activity and Its Impact Lenders also watch your recent activity. Multiple credit inquiries in a short time can lower your score. Opening new credit accounts or applying for loans can signal financial stress. This may trigger suspicion, even if your credit score remains decent. Be cautious about new credit during the homebuying process. Credit Report Errors and How They Can Sabotage Your Efforts Reports often contain mistakes. Accounts mixed up with someone else, outdated info, or paid debts marked unpaid are common errors. These issues can unfairly lower your score or cause your application to be rejected. It’s smart to request a free credit report from the three bureaus—Equifax, Experian, and TransUnion—before starting the loan process. Dispute any mistakes you find. The Effect of Seasonal or Irregular Income Your income stability matters more than you think. If your paychecks vary wildly or you recently changed jobs, lenders might see you as a higher risk. Showing consistent income over time and providing proof of savings can help you present a stronger financial profile. Lender “Black Holes”: What Isn’t Disclosed The Influence of Non-Credit Factors Lenders consider many things outside your credit report. Your down payment size, employment history, and how much cash you have saved show your financial reliability. Making a larger down payment can sometimes compensate for a lower credit score. Similarly, a steady job history boosts confidence in your ability to repay. The Impact of Credit Score “Ranges” and Lender Policies Different lenders set their own cutoffs. FHA guidelines differ from banks’ internal policies. Some might be more flexible, while others have strict limits. These hidden thresholds aren’t always clear upfront, which can trip up buyers who don’t ask the right questions. Hidden Fees and Rate Adjustments Lenders may modify your rate based on factors they don’t openly share. For example, they could add fees or increase your interest rate if your credit profile is slightly below their preferred threshold. Comparing multiple offers helps you spot these hidden costs. Practical Strategies to Improve Your Chances Building and Maintaining Healthy Credit Start early. Pay all bills on time, keep your balances low, and avoid opening many new accounts at once. Request your credit reports regularly to spot errors. Small actions today can boost your score before applying. Preparing Your Financial Profile Reduce debt payments to lower your DTI. Save for a larger down payment and keep a comfortable emergency fund. When talking to lenders, highlight your stability and savings. Sharing good financial habits can sometimes offset minor credit issues. Negotiating and Choosing the Right Lender Ask questions about their approval criteria. Do they consider income stability or savings more than your credit score? Shop around. Different lenders treat the same profile differently. Comparing offers can get you better terms. Leveraging Professional Help If your credit is less-than-perfect, seek a credit counselor or mortgage broker. Pros understand hidden criteria and can guide you through the process. They might suggest ways to improve your profile quickly or find lenders willing to overlook minor issues. Conclusion Your credit score is a vital piece of the homebuying puzzle, but it’s just one part. Many factors influence whether you get approved and at what rate—factors lenders don't always share openly. Being aware of these hidden truths puts you in control. By managing your credit, reducing debt, and shopping smart, you can avoid falling into the credit score trap. The more you understand, the better your chances of securing that dream home with favorable terms. Take charge of your financial future today and move closer to homeownership with confidence. Visit my webpage for Instant Home Cash Offer

-

Global Micro Lending Market size is at a CAGR of 11.00% The Global Micro Lending Market size is expected to be worth around USD 588 Billion By 2034, from USD 207.1 Billion in 2024, growing at a CAGR of 11.00% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific led the global micro-lending market with over 45% share and USD 93.1 billion in revenue. China alone contributed USD 30.5 billion, growing at a CAGR of 8.2%, fueled by demand from small businesses and individuals. Read more - https://market.us/report/micro-lending-market/ The Micro Lending Market refers to a specialized segment of financial services where small loans, typically provided without collateral, are offered to individuals or small businesses that lack access to traditional banking services. This market plays a crucial role in promoting financial inclusion, particularly in underserved regions. It is often driven by microfinance institutions, fintech companies, and non-banking financial corporations that focus on empowering low-income populations, entrepreneurs, and women-owned businesses. As of now, the market is experiencing strong upward momentum, thanks to growing awareness about the importance of inclusive finance and the rise of digital platforms. One of the top driving factors behind the growth of the micro lending market is the rising demand for accessible credit options in developing regions. Many individuals still operate outside the formal financial system, and micro lending offers them a lifeline. Additionally, the increasing penetration of mobile phones and internet connectivity has made it easier for lenders to reach remote borrowers, further propelling market expansion.

-

Changing your Apple ID country or region is sometimes necessary if you’ve moved to a new country or want access to a different regional App Store. To do this without losing your data, it's important to prepare your account properly. First, ensure you’ve used any remaining store credit and canceled any subscriptions, including Apple Music or iCloud+, as these can prevent the region switch. Next, back up your data to iCloud or a computer to safeguard your information. On your iPhone, go to Settings > [Your Name] > Media & Purchases > View Account > Country/Region, then select your new country and agree to the terms and conditions. You’ll need to enter a valid payment method and billing address for the new region. Read more - https://www.tai-ji.net/board/board_topic/4160148/6838826.htm

-

Loan Apps That Lighten Life’s Load Financial requirements can come up at any time in the fast-paced world of today. Whether it’s an emergency medical bill, urgent home repair, or a sudden travel expense, having quick access to money can make all the difference. This is where loan apps come in they offer fast, convenient, and accessible solutions to ease financial burdens. In this blog, we’ll explore how loan apps lighten life’s load by providing quick support and making borrowing simpler and safer. How Loan Apps Provide Quick Financial Support One of the biggest advantages of loan apps is their ability to deliver fast financial assistance. Unlike traditional banks, which often require long application processes and paperwork, loan apps simplify borrowing by using digital processes. Most apps offer instant loan approval decisions, sometimes within minutes, and the funds can be transferred directly to your bank account quickly. This speed is a game changer, especially in emergencies when waiting days or weeks for a loan could worsen the situation. Loan apps typically use automated credit checks and alternative data, so even users with limited credit history can get loans. This quick access to cash helps reduce stress and keeps life moving smoothly during tough times. The Convenience of Borrowing Money from Your Phone Loan apps bring the borrowing process directly to your fingertips. You no longer need to visit a bank branch or fill out complicated forms. Everything from applying for the loan, uploading documents, signing contracts, to tracking repayment can be done easily through your smartphone. Because of this ease, you can apply for a loan at any time and from any location, including your home, place of employment, or while on the go. The apps are designed with user-friendly interfaces to make the process straightforward, even for those who aren’t tech-savvy. Plus, many apps provide helpful customer support right within the app, so you’re never left wondering what to do next. How Loan Apps Help You Manage Unexpected Expenses Because life is unpredictable, unforeseen costs may cause your budget to become unbalanced. Loan apps are designed to help you handle these surprises without derailing your finances. Whether it’s a car repair, urgent medical bill, or school fees, having access to a loan app means you can quickly cover the cost without dipping into your savings. Many loan apps offer flexible repayment plans and small loan amounts tailored to your needs, so you don’t borrow more than necessary. This makes managing your finances easier and helps prevent long-term debt problems. By providing quick, manageable loans, these apps act as a financial safety net when you need it most. Why Loan Apps Are a Better Alternative to Traditional Loans Traditional loans often involve lengthy paperwork, credit checks, and long approval times. For many people, especially those with less-than-perfect credit scores, getting a loan from a bank can be challenging or impossible. Loan apps remove many of these barriers by streamlining the application and approval process using technology. Additionally, loan apps often have lower fees and transparent terms compared to payday loans or cash advances, which can carry exorbitant interest rates. The ability to apply from home, faster approval, and more flexible terms make loan apps a better choice for many borrowers. Moreover, loan apps promote financial inclusion by giving access to credit for people who may not qualify for traditional loans, such as freelancers, students, or those without formal employment. Tips for Choosing the Right Loan App for Your Needs With so many loan apps available, choosing the right one can be overwhelming.The following advice will help you choose a reliable and appropriate app: Check Interest Rates and Fees: Compare rates and hidden charges to avoid expensive loans. Read Reviews: Look for user feedback to learn about the app’s reliability and customer service. Verify Security Measures: Ensure the app uses encryption and safeguards your personal data. Look for Transparent Terms: The app should clearly explain repayment terms, penalties, and all costs upfront. Customer Support: Choose an app with responsive customer support to help you in case of issues. Loan Flexibility: Find apps that offer loans matching your needs, including repayment schedules and loan amounts. Taking time to research will save you from unpleasant surprises and help you make the most of the loan app’s benefits. How Loan Apps Can Improve Your Financial Health Using loan apps responsibly can contribute positively to your financial well-being. By providing quick access to funds, these apps help you avoid high-interest payday loans or costly overdraft fees. When used wisely, loan apps can smooth out cash flow problems and keep you afloat during tight months. Moreover, many apps offer financial education resources and reminders to help you stay on track with repayments. Timely repayments also help build your credit profile, improving your chances of qualifying for bigger loans or credit cards in the future. However, it’s important to borrow only what you need and ensure you can repay on time to avoid debt cycles. Loan apps can be effective instruments for preserving peace of mind and financial stability when used properly. Conclusion Loan apps have transformed the way we access credit by making borrowing faster, easier, and more accessible. They lighten life’s load by offering quick financial support, helping manage unexpected expenses, and providing a convenient alternative to traditional loans. By choosing the right app and using it responsibly, you can improve your financial health and navigate life’s challenges with greater confidence. If you haven’t tried a loan app yet, now might be the perfect time to explore how these digital tools can support your financial needs and bring ease to your everyday life.

-

How to use United Airlines Credit? Passengers traveling with United Airlines can use their credit points, if they have them. To find the points, you can use the United Flight Credit Lookup tool and use these points to book or upgrade flights for your future trips. Using the United Flight Credit points, you can lower your prices for the flight you want to book. Read more: https://www.airlinesgrouptravel.com/blog/united-airlines-flight-travel-credit